The eighth part of the Series is “Current temptation, future frustration”. This series is based on the companies which are currently darling of the market and many trying to catch such opportunities but it has a probability to become a reason for future frustration. It can wipe out the majority of gains in wealth. I am trying to put some of the number-crunching facts by which we can identify ongoing issues in the companies and can save our wealth.

I am starting this article with one of the company which is engaged in consultancy and advisory services in the field of management, IT, technical, industrial, personnel and labour, legal and taxation, financial, commercial and investment, capital market, consulting engineers, operational research consultants, computer service, and marketing services has a 52 weeks low price of Rs.5.26 and LTP is Rs.93.6, 52-week high price – Rs.99.5. This company has rewarded ~17.79x of return in a year.

Let’s start looking at the numbers.

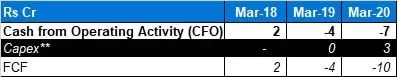

We can see that the company has a high volatile OP Margin%, the company has achieved the highest ever profit in FY20. So this matrix seems good.

When we look at the common size balance sheet, then we come to know that the highest assets side item is other assets. Now, a consultancy company can have such an item but still, we have to do further digging.

The majority of assets account for loans and advances which nearly 85% of the total balance sheet. The company has not given any detailed breakup of loans. But when we read further notes then

The above note put seeds of doubt in our mind.

The company has major expenses are recorded as per bad debts which is 13.66x and 75.48x of net profit in FY20 and FY19 respectively. This will create trouble for the company.

The company does not have a good return ratio.

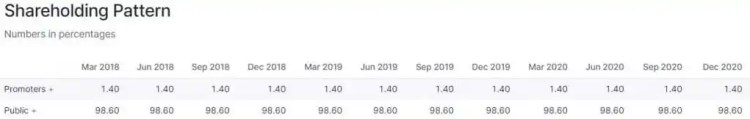

When we look at the shareholding pattern then promoters hold only 1.40% and the remaining hold by the public. If the promoters have trust in the performance of the company, then they have to hold higher holding.

Disclosure – Companies mentioned in the article are just for an example & educational purpose. It is not a buy/sell/ hold recommendation.

This series contains learning from books –