The seventh part of the Series “Current temptation, future frustration“. This series is based on the companies which are currently darling of the market and many trying to catch such opportunities but it has a probability to become a reason for future frustration. It can wipe out the majority of gains in wealth. I am trying to put some of the number-crunching facts by which we can identify ongoing issues in the companies and can save our wealth.

I am starting this article with one of the company which is engaged in the textile business has a 52 weeks low price of Rs.11.6 and LTP is Rs.38.8, the 52-week high price of Rs.47.8. This company has rewarded ~4.12x of return in a year.

Let’s start looking at the numbers.

We can see that the company has a high volatile OP Margin% and also having losses at a net level in few years.

When we look at the balance sheet then it seems that the company has an issue with higher debt and continues dilution of capital. We can see that though the company has diluted capital, the solvency ratio has worsened.

We can see that the company has huge related party transactions. Also, the major deposit given to the related parties.

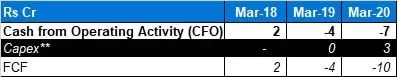

Also, we can see that the company has negative CFO and FCF in the last three years which indicates that profits are not getting converted into cash profit.

Disclosure – Companies mentioned in the article are just for an example & educational purpose. It is not a buy/sell/ hold recommendation.

This series contains learning from books –

Pingback: 07 – Current temptation, future frustration – LUCKY IDIOT - Cockpit news -sofwarecockpit