The 12th part of Series “Once a darling, now an evil”. This series is based on the companies which were once upon a time darling of the market and now, it has wiped out the majority of all those gains. I am trying to put some of the number-crunching facts by which we have identified ongoing issues in the companies and have saved our wealth.

I am starting this part with one of the company is in the business of global education company, with presence across the US, 40 counties in the UK, Pan India, Singapore, 9 countries in MEA, Hong Kong and 2 countries in the Caribbean which has an all-time high price of ~Rs.437 in 2008, ~Rs.338 in 2012 and now last traded price at Rs.1.77.

In the first instance this company having huge sales & PAT growth. Also, the narrative of the business seems good. But such growth and good narrative should not be a reason for investment.

So, we go deeper ….

Here, we can see that debtor day and inventory days are growing rapidly with fall in payable days which has to turn out a cash conversion cycle to positive from negative & growing rapidly. Assets utilization & return ratio are falling.

I would like to go further detail of it.

Here, we can see that CFO is lower than PAT with cumulative CFO of FY07-12 is Rs.779 cr whereas cumulative PAT is Rs.982 cr so that CCFO<CPAT which indicates that company has a working capital issue which we have seen in debtor days and inventory days also.

If we here look at the depreciation cover then initially it was higher but that is due to lower depreciation rate. Later on, that depreciation rate has become almost double. This has an impact on CFO.

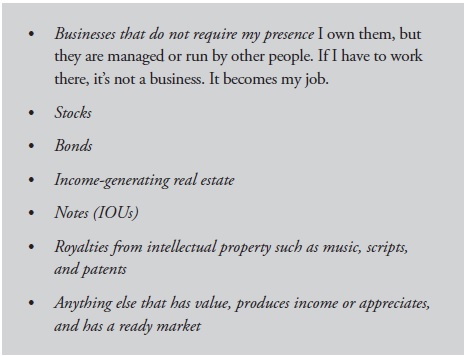

We can see that the borrowing part is growing in overall sources of funds and on the other side the highest part is other assets.

Let’s go deeper into it one by one.

Here, we can see that company has software development is in inventories but similar inventories are not available with Infosys and TCS annual reports, even not in their initial years’ reports. The company is capitalizing inventories as well as few other expenses on the name of inventories which has boosted profits but has affected balance sheet and cash flow statement.

Journal entry of Inventory

Cost of goods sold expenses Dr

To Inventories

So when inventory gets sold costs are recognized into income statement but if you keep showing inventory not sold out then cost also gets understate which boosts profit artificially.

Here, we can see that company has intangible assets under development is Rs.529 cr in FY2012 and Rs.313 cr in FY11; Goodwill on Consolidation (arises due to investment in subsidiaries) Rs.118 cr in FY2012 and Rs.70 cr in FY11. These two items are 18% of the balance sheet. This is again a capitalization of expenses to balance sheet.

Journal entry of cost capitalization into assets

- Assets Dr

To Cash

When we recognize assets created as expenses –

- Expenses Dr

To Assets

So that cash keeps on reducing but borrowing keeps growing because there was just a capitalization of costs and not actual assets creation. This again boosts profits but when we look at the FCF then FCF always comes negative.

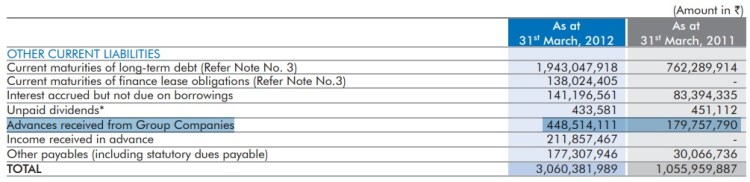

The company got an advance from group companies which increases the current liabilities part.

Here, the company has created provisions for fringe benefit taxes which a tax that an employer has to pay in lieu of the benefits that are given to his/her employees. A company has a pending to pay it means either company does not have enough money to pay it or they have created provision during the good time so that they can write back to boost profit.

Journal entries

When provision/liabilities get created

Profit & Loss A/C DR

To Provision/liabilities A/C

When the provision was written back

Provision/liabilities A/C DR

To Profit & Loss A/C

The company can boost profits whenever it requires to do.

The company has Rs.58 cr in the current account and Rs.37 cr of cheques on hand which is combined 60% of total cash and cash equivalents. Why does the company need to keep large funds into a current account where it does not get any interest?

In addition to all the above factors, the company has given a loan to related parties worth of Rs.116 cr in FY12, investment into subsidiaries worth of Rs.34 cr in FY12. We can see that company has put good efforts to hide many aspects but if we go into deeper, understand numbers, and read annual reports then it can visible to us.

Disclosure – Companies mentioned in the article are just for an example & educational purpose. It is not a buy/sell/ hold recommendation.

This series contains learning from books –Financial ShenanigansQuality of EarningsThe Financial Numbers GameCreative Cash Flow Reporting