Dear friends,

Let me try to explain Return on Equity in a simple manner.

What is RoE (Return on Equity)?

“Return on equity measures a corporation’s profitability by revealing how much profit a company generates with the money shareholders have invested.” — Investopedia

Return on Equity = Net Income/Shareholder’s Equity

That means in a simple manner % return which we earn by making profit from amount which we have invested, our own money.

If I had put Rs.100 in bank FD and on that Rs.100, I get Rs.8 then my RoE (%) on that particular investment is 8%.

Higher the RoE (%) means we can able to generate higher profit by utilizing our funds. So that incremental profit generation helps us for fulfilling our wishes and also can able to secure our future also.

The same concept applies with company’s RoE (%).

Higher the RoE (%) means company can able to generate higher profit by utilizing their funds. So that incremental profit generation helps to the company to survive for the longer period of time and also can able to make good wealth creating decisions.

Always high RoE (%) is good and should believe it blindly ????? And not to believe it blindly then why?????

Now, question is why always consider debt when calculating RoE????

What is debt?

“Debt is an amount of money borrowed by one party from another.” (Investopedia)

A debt arrangement gives the borrowing party permission to borrow money under the condition that it is to be paid back at a later date, usually with interest.

Means borrowing Rs.100 with conditions to pay back with Rs.110, if 10% interest rate.

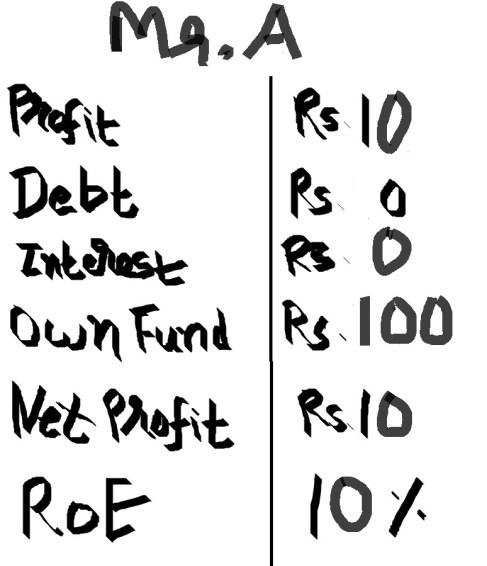

Let me explain 3 different situations with an examples —

So that with a higher debt level, RoE (%) shows higher because of lower level of own fund and profit is excess of interest payment. But what if odds get wrong.

Risk and uncertainty never comes to us with prior intimations. So we must have to be very careful.

Sometimes its happen that we stay lucky enough to not faced risk in our life time but surprise and shock happens as it never happens before.

https://www.youtube.com/watch?v=hQs47IT-d78

Now, let me take an example with the situation where surprise come and start earning low profit —

Thus, as company or an individual who having higher level of debt then they only benefited till negative surprises not come to their life. But as negative surprises start coming then survival become a question mark for the companies as well as the individual.

This is only the reason why we try to select business having no debt because if worst happens then also business can able to survive.

And if we found business with debt then must need to check earning and interest payment situation. Earning must be much higher then interest payment; so that can chances to survive with the worst situations.

Bonus

Same we do also in the stock market —-

We forget worst scenario when surrounding us all happens good and start believing that

But my dear friends, time is always the same.

And then result of believing this time is different is —

Just one single moves enough to destroy us if we have built our portfolio on leverage or play with stock market with leverage.

Time always remain same; it’s a pendulum so not focus on making early huge returns which can cause to destruction of your life.

Inspired by — Safal Niveshak and Fundoo Professor

What is best leveraging normally industry wise

Thank You for writing to me.

According to me, there should be a no debt or a lower debt situations. And if debt is with company then there must be an interest cover of at least 4x.

If such interest cover is not there with company then I tried to avoid investment with particular company.

I look above criteria for all industries.

Great work man the topic that you have taken in your blog ROE is really amazing and the way that you describe the topic is really likely to be read.

Thank You….

Pingback: Why considering RoCE (Return on Capital Employed) with RoE (Return on Equity) is better???? | Lucky Idiot

Very well explained in simple language. Best for anyone to understand.

Thank You Very Much Sir….

Very nice, well explained. Thanks.

Thankssss.

awesome explanation

Thank You Very Much….

Nice work

Thankssss