Mr. Graham has mentioned a few points which need to be check for any of the companies in which we are planning to make an investment. And if the company having such points then should avoid it is a better choice.

- The company not paying income tax through earning profits. We must have doubts about the earning of the company if the company continuously not paying income tax. We need to check whether the company has any tax benefits or not. If the company has any tax benefits then we need to check where such benefits are going to expire and need to adjust tax benefits for our calculation of future estimation of profitability / per-share earnings.

- Overpriced giant companies. Giant companies are those which have shown decent growth in the past and gaining market share. Thus, such companies have won the trust of the investors and available at a higher valuation. We need to understand that not always a great company can be a great investment. Also, we need to stay away if the company available at an extreme higher valuation. One of the current giant IT companies was traded on 200+ of P/Ex during the IT bubble and after that company has posted sales & profitability growth of 30%+ but the stock has given return ~7-8% CAGR during that period.

- Interest coverage is less than 5x. If the company cannot able to generate pre interest profit 5x higher than the interest amount then any unforeseen circumstances can affect the profitability of the company.

- The company involves frequent mergers and acquisitions. Frequent merger and acquisition turn a simple financial statement into a complex which becomes much difficult to understand. In addition, the company can hide many things through mergers and acquisitions which becomes difficult to identify.

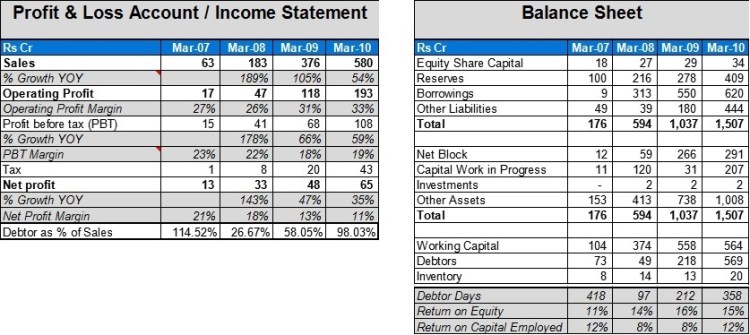

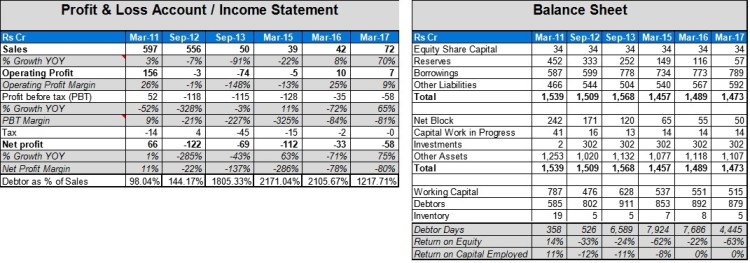

- Merger and acquisition are huge in size compare with the size of the company and also, funded through huge debt. Such M&A can create trouble for the company if not played well. The majority of such M&A has failed badly. One of the steel company which has done an acquisition of the company which is huge in size by taking a huge debt.

- Here, we can see that the company has faced a hugely difficult to get survived. Also, the company has to take a huge debt + equity issuance.

- Acquisition of the company at a higher valuation. When one company has acquired another company at higher valuation then it will consider as a capital misallocation and it will take time to cover the extra value which the company has paid. If the company has paid a huge premium + balance sheet also not stronger than it can be troublesome.

- Frequent merger and acquisitions. This will create trouble for an investor to understand financial statements. In addition, the company can hide many things under such frequent M&A and can boost up revenue and profitability in a fraudulent way.

- Deferred debt expense which is greater than entire shareholders fund

- Amortization of deferred debt expense

- The company has a debenture that is traded at a huge discount then also, the company buying warrant.

- Increasing debt in more peace compared with the revenue

- We need to deduct preferred stock payment, debenture payment from available cash & investment of the company to reach the conclusion regarding available cash & investment for the common stockholders.

- Checking a liquidity position of the company

- Expansion strategy, if expansion is huge enough that it has a higher probability to get fail, the profitability of the company can wipe out. And if such a huge expansion funded through external fund then can be the hero or zero kinds of situation arise.

- One of the chemical company of India has announced a huge expansion plan which is a hero or zero kinds of plan

- Here, we can see that the company can able to grow its revenue and profitability after the huge Capex which has helped the company to get survived very well.

- The company owning huge preferred, warrants and convertibles then need to check such companies with more patience or should avoid it.

- Changes into the method of arriving at the pension

- Changes into the depreciation rates

- Stock trading at Extreme cheapness. When things available at cheaper valuation then we need to be cautious and ask to question & try to find out the reason for cheap valuation.

- Avoid hot stocks and hot fancy businesses

- An initial public offering of shares in a basically worthless company. IPOs of the company which are not good in the balance sheet and just coming up with an IPO due to fancy in a sector or in the market.

- Inspection from SEBI or other regulatory authorities. When we come across such news then we need to study carefully with that company.

- Few more things to avoid – MY LEARNING FROM MY MISTAKES

Disclosure – Companies mentioned in the article are just for an example & educational purpose. It is not a buy/sell/ hold recommendation.

Read for more detail: The Intelligent Investor by Benjamin Graham, Jason Zweig