Learning from Kite flying festival for investing in equity shares

Shocking…. Shocking……

Yeah…. some of the common and basic learning….

There are lots of learning that we can learn about an investing if note down common things happening in the world. Investing is all about common sense and if we use it, we can earn from investing in equity.

For creating wealth in long-term, we need to invest in the business which having potential to go far and stay on the top. So such we can learn from kite flying.

Let me explain it in a simple manner….

So when we select an any kite, we check that it’s not broken, suitable to fly, size & shape of kite, etc.

If kite is not proper or it broken, then difficult to fly it.

Let’s consider kite as a business.

If business is not proper, huge debt or having cyclical nature, then become difficult to earn by making investing to such business. So first we need a good kite (good business) to take off.

Now, if kite is good then it can easily take off and start flying well. But what if thread is not strong????

Kite start flying but not survive in the sky and easily other kite won that battle, and easily acquire position in the sky.

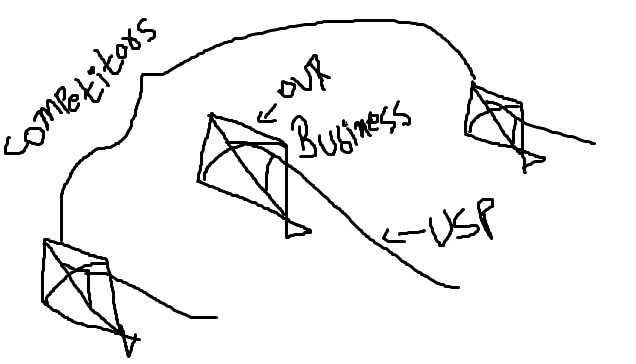

Let’s consider thread as a competitive advantage (USP in a simple manner) and other kites as a competitor.

If our business doesn’t have any strong USP then competitor easily won market share. For survival to the market, business needs a strong USP which competitor cannot easily replicate and won market share. If we having strong thread means strong USP then we can able to won market share and survive for the long-term.

As no kite stay at sky for forever and at last other kite with strong thread won battle as the same no USP stay for forever but strong USP at least stay for the longer horizon and help business to survive for the long-term. Also as kite go higher and higher then become difficult for other kites to defeat that kite as the same as business and it’s USP grow stronger and stronger then it will become difficult for the other competitors to defeat that business.

At last but not the least……

We should never forget the important of the person who hold the kite and make it fly. So if u have good kite, strong thread but not a good person who make kite to fly higher then it will difficult for the kite to survive and to go higher.

But the person is strong then he makes not only good kite but also a bad kite to fly well and bring it on the higher side and stay long to sky.

Let’s consider person who hold the kite as a manger.

So if manager is not strong then business with strong USP also can’t able to survive for the longer period of time.

Bad manager destroys good business with strong USP.

Strong manager doesn’t care that business is good or not, he run it in a well manner so that business grow better and survive for the longer period of time.

Not only person who hold the kite but also the person who hold sets of thread (Firki) is also important. If he not supports well to the person who hold kite, then going higher and higher become difficult.

So the partner or key employee also supportive and working for the same vision as the manager then it will become easy for the business to grow well and survive for the longer period of time.

One bonus

If we not take care and use safety around the kite flying area, then we get damage from thread so as the same if we take over leverage and speculating then our position also become difficult to survive.

Conclusion

For creating wealth through investing in equity then we need —

- Good business

- Strong USP

- Strong manager

- Strong partner or key employee

Pingback: LEARNING FROM KITE FLYING FESTIVAL FOR INVESTING IN EQUITY SHARES PART – 2 | Lucky Idiot

Very good….great work..

Good learning yar

Thanks

Superb concenpt

Extremely easy to understand

Thanks for making us understand such depthful article in this fashion

Thank You Very Much…..

Nice philosophy

Its a good one. Keep it up.

Thank You Very Much…..