If we see many of the richest people have failed and died in a poorer life. What happened to them? What can be the true reason?

If we have a Money without proper financial intelligence then it will sooner or later find a way to go away from us. It is not always important to make huge money but important is to learn how to keep money with us. If we make huge money and does not able to keep it with us then that is of no use.

“Rich people acquire assets. The poor and middle class acquire liabilities that they think are assets,” said rich dad.

We must have to understand the difference between assets and liability for getting rich.

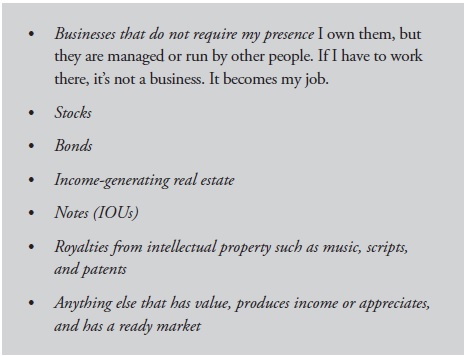

What we need to understand for understanding assets and liability are – An asset puts money in my pocket. A liability takes money out of my pocket.

As our income increases, similarly, our expense increases or might be increased higher than income. This will further increase our liability side such as mortgages, credit cards payments, etc. We go for the shopping, we make shopping with full of credit card, we extend our loan for 30 years to make yearly lower payments. And these all keep pushing us to the rat race. These liabilities make us helpless to continue with the rate race. But when we look for the cash flow pattern of a rich person then the rich person has many assets which help to manage all the expenses and also has multiple income streams. Creating multiple assets only help a person to become a rich person.

A person can be highly educated, professionally successful, and financially illiterate.

We keep on repeating the same mistakes again and again – get a secured job, work hard to get a good paycheck, diversify, our house is an asset, our house is our biggest investment, don’t make a mistake, don’t take a risk etc.

Fear of sports, relationships, getting socialize, career, business, money and all these attract us to play in the safe. We start evolving ourselves, outlook our fear and look inside to find out our wisdom. Our education system is designed in such a way that we get trapped into many of the fears. Schools teach us to study well, get good grades, get a good job. Does it solve our actual problems? When I look back and think then I got an answer that they produce me as a good employee but where are the good money handling skills, skill to engage money to work for myself, skill to become an employer? I have to build all these by myself and if we think calmly then similar has happened with the majority of us.

The mindset of the majority of us in the society is led us towards a safer zone which creates a distance. This mindset creates distance between rich mindset people and poor mindset people, between us and the majority of society. The same I have observed in my life. I always remain a bright student during my studies because I always taught in a way that I have to get a good grade and get a good, secure job. Though many of my family members are engaged in the business. I never have forced to do what everyone else said, I have a freedom of decision but I cannot get escape from the mindset of everyone and engage into the biggest mistake with accepting that common mindset. I have always told to my professor that one day I will become a successful businessman but my mindset was not suitable for that decision. My mindset is of getting safer and secure, fear of losing paycheck due to struggle in past. I experience that struggle with the proper mindset can build us stronger but struggle with a poor mindset builds us weaker. So that as I keep on achieving my different dreams but get distance from original dreams of becoming independent, freedom of time and getting financial freedom. I am telling this from my experience that, it is much difficult for us to change our mindset. It took a tremendous time for me. I suggest it to everyone that we should get out of the trapped from such fears in our early life, else we have to suffer a lot and have to do a tough fight with ourselves to get proper mindset.

I have discussed in the previous chapter that we should use emotion to favour our financial decision. But we get much emotional when it comes to making a financial decision. Especially house, I have a personal experience regarding it. All of my relatives forced to sell off my old house and moved to the bigger house by taking a huge loan for 20 years. In our society, the house is our status symbol, good big house for welcoming society people, proof of getting more wealthier (as we get wealthier, we have to move from old smaller house to new bigger house), proof that we are working with a good paycheck, getting lots of hate & humiliation if not upgrading your house, vehicles, lifestyle with an upgraded paycheck. But no one guides an investment, how to make extra money which can support cash outflows, they advise how to stay with rat race only.

We should buy a house but first, we need to create an asset which supports the cash outflows due to purchase of a new house.

Why rich get richer? The answer is into the above image. Rich having a more asset than liabilities which generates enough cash flow to support all expenses and left with huge for reinvesting it for an asset. This process helps them to grows their assets and income from assets. Such activities led to make them richer.

Opposite activities performed by the poor and middle-class people. And that brings them down more and more. Also, keep them into the rat race. This class only has one source of income and that is salary. So, for increasing their income they have to be strongly performed into the rat race. Poor and middle-class people are taking the major risk by playing safer and not taking a risk.

People attract towards the products which seem to be safer to them. If we want to sell any of the products to the people then show it as a safer product, everyone stands into the queue to purchase it.

Mr Fuller has defined wealth – Wealth is a person’s ability to survive so many numbers of days forward—or, if I stopped working today, how long could I survive?

When we have a lesser expense, lesser liabilities compared to the income and assets then obviously we will survive for a longer period. Else, we will go out of the game soon. Similarly, we can compare with the companies in which we want to invest.

Disclosure – Companies mentioned in the article are just for an example & educational purpose. It is not a buy/sell/ hold recommendation.

Read for more detail: Rich Dad Poor Dad: What the Rich Teach their Kids About Money that the Poor and Middle Class Do Not!

Like this:

Like Loading...