As we seen few learning from movie “Rajneeti”. Now, we try to learn some learning from movie “3 Idiot” which is one of my another most favorite movie. This movie, many dialogues and scenes from movie has help me to learn many lessons. For me, this movie is full of learning and enjoyment.

- “Mera beta engineer banega” (My son will become an engineer) and Character of Virus

We are treating ourselves as a participant of Race and always keep on running for coming 1st.

In our investment field also, investors running for identifying multibagger stocks ideas rather than focusing on safety of principal. Also everyone tries for outperforming index and as well as other investors. If any other investor or index outperform by 1% also then many “so called investors” gets upset. Many forget definition of Graham and then also calling themselves as an investor.

“An investment operation is one which, upon thorough analysis, promises safety of principal and an adequate return. Operations not meeting these requirements are speculative.” — Ben Graham

- Padhne k liye uniform chahiye (For learning, we just need uniform of any school)

We can able to learn from everywhere in the world. If we want to learn then it’s not always be a requirement of formal education. We can learn by any sources.

It’s not necessary that for making investment decisions, we need to study regarding financial field. Many of my friends who doesn’t having formal financial field education but making very good investment decisions and also outperforming persons who having formal financial field educations.

- Definition of Machine – Machine is anything that reduces human efforts

In this scene, we have seen that simple definition given by Amir khan was not accepted by professor at classroom.

Same with our investment field. People and even also many “so called investors” attracted towards difficult jargon and like to make difficult ideas. Make forecasting of coming 3-4-5 years of earnings, forward EPS, forward P/E, etc. But not like to focus on what currently business having.

We all believe that difficult investment idea only will provide us a good return rather focusing on simple understanding. We try to understand and try to apply the whole process of making and investment rather memorizing everything. If we have memorized all concepts but can’t able to apply it then we will not able to create good portfolio.

Memorized concepts and using difficult jargon can able create impression on mind of people but might not help you for getting a good return from the portfolio.

- Chabuk ke darr se toh circus ka sher bhi uchhalkar kurasee par bethna sikh jata hai; lekin aese sher ko hum “well trained” kahte hai, “well educated” nahi. (Even a circus lion learns to sit on a chair in fear of the whip, but we call such a lion as a “well trained”, not “well educated”)

This is one of the most popular dialogue from movie. That means we should try for getting well educated rather just being well trained person.

Market ke support se toh koi bhi returns earn kar dega, use hum lucky kahege, investor nahi.

People focusing on chasing returns but not focus on real process. Many gets more returns due to support from market, not due to their own skill but they try believing that those returns because of their own skill. We should try to focus on understanding real process and philosophy of investment rather focusing on return.

- kamyab hone ke liye nahi, kabil hone ke liye padho. kamyabhi jhak.. Mar ke piche ayegi… (Study for become a capable, not affluent. Follow excellence, and success will follow you.)

This means learns for real development, not just for achieving short-term targets. If we working for our own development, then all success comes directly to us.

Same with investment, we should not make investment for getting multibagger returns but focus on safety of principle, returns comes automatically. We try to understand process and need to apply it.

- Chatur’s speech

This scene teaches us that don’t memorized books, try to understand concepts. If we keep on memorizing without understanding, then many times we may have to face embarrassing situation.

Same with investment, if we buy without understanding what we are buying then many a times we have to pay a high amount for it. Many people try to copy portfolio of legends (RK Damani, Ramesh Damani, Rakesh Jhunjhunwala, Porinju, Prof. Bakshi etc.) without understanding why they are buying, then many times we might have to face very embarrassing situation (Portfolio ka balatkaar hota rahega).

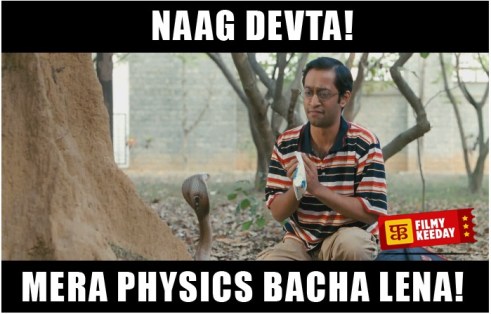

- Results announcement day

When result announcement date comes then many students started fearing and also started praying to God for getting good marks.

Many investors also behave in similar manner. Also started fearing and praying for good quarterly and annual results of companies are in their portfolio. If we have make good homework before making any investment decision, then we need not to be worry about the outcomes.

- Do whatever you like

Many are not knowing what really they like. Means many people don’t know that what they really like making an investment or doing trading. So we need to understand what we like and what is our philosophy for making an investment decision. And most important is to always stick with it rather getting influence by others.

Watch movie “3 idiots” for better understanding above article.

Pingback: Learning investment lessons from movie Avengers: Endgame | Lucky Idiot

Pingback: LEARNING INVESTMENT LESSONS FROM MOVIE BADLA | Lucky Idiot

Pingback: LEARNING INVESTMENT LESSONS FROM MOVIE “SANJU” | Lucky Idiot

Pingback: LEARNING INVESTMENT LESSONS FROM MOVIE “Dangal” | Lucky Idiot

Tussi Great ho…

Thanks bro….

Superb article sirji.

Thanks…..

Very nicely classified. well done.

Thank You Uncle….