WB Letter 1987

Mr.Buffett indicates the behavior of most of the investors and which should be avoided.

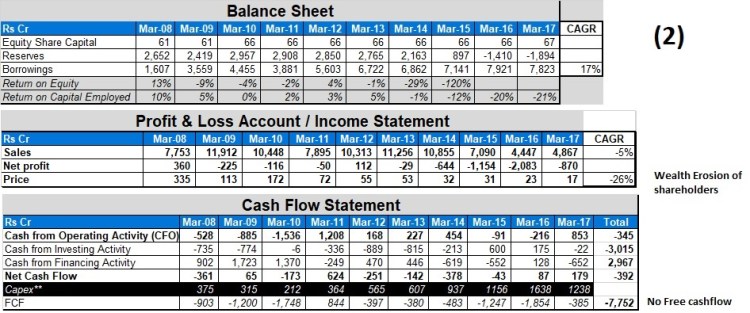

Companies which can perform well and earned 20% above return on equity, all those companies have also performed well into stock-market in terms of stock prices. But such companies are few and we need to identify those and sit tight with holding those companies. Companies which have a good earning power then those companies do not require the debt.

Mr.Buffett indicated that they do not cut down budget as the profit of the company falls. He has always focused on the employees and their welfare. We have seen that the Textile division of the company remains to continue for the longer period only due to largest employees’ works at the company.

Whenever the shortage of a particular commodity arises then prices of particular commodity start rising and commodity companies start getting benefits of price raised.

We should enter into the commodity companies when there is an excess supply and price of the particular commodity is traded lower which having a lower profitability, lower return ratio, such lower prices bring bankruptcy to weak companies etc. and should try to exit when shortage of supply and price of the particular commodity is traded on a higher side. But generally, we forget it and enter while the financial matrix of the commodity companies already improved which creates wealth destruction.

Major mistakes made by an investor in the cyclical company is that they choose to invest when commodity prices are at higher level, return ratio improves well, profitability margin improves, etc. We should try to avoid such mistake.

Additionally, Mr.Buffett explained the philosophy of Ben Graham to see a market. Ben Graham quote market as Mr.Market and price moment as the mood of Mr.Market.

Mr.Buffett has made a point regarding when he will ready to sell his existing security in which he has made an investment. These points can be used as a checklist for selling decision of our investment.

People have misunderstood saying of Mr.Buffett and they keep on believing that Mr.Buffett never sell his investment and keep on holding it forever. But in reality, it is fact. He is also ready to sell securities when the above-mentioned criterion matched with his investment and he holds till the above-mentioned criterion does not match.