Mr.Buffett has taught us –

Never count on making a good sale. Have a purchase price be so attractive that even a mediocre sale gives good results. The better sales will be the frosting on the cake.

Our business is making excellent purchases – not making extraordinary sales.

Mr. Buffett believes that big money can be made by making investment decisions based on qualitative factors whereas sure money can be made by making investment decisions based on quantitative factors. And hence, on the basis of this; he considers himself as a quantitatively focused investor.

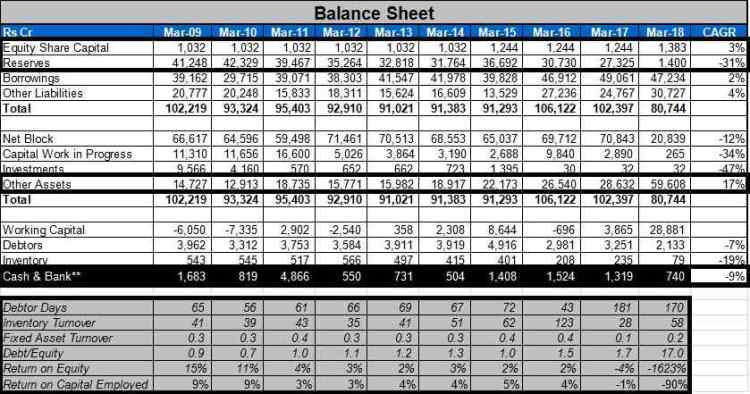

The primary test of managerial economic performance is the achievement of a high earnings rate on equity capital employed (without undue leverage, accounting gimmickry, etc.) and not the achievement of consistent gains in earnings per share.

Business must have two characteristics: (1) an ability to increase prices rather easily (even when product demand is flat and capacity is not fully utilized) without fear of significant loss of either market share or unit volume, and (2) an ability to accommodate large dollar volume increases in business (often produced more by inflation than by real growth) with only minor additional investment of capital.

Many a time, management only focuses on the increasing future Earning Per Share (EPS) by sacrificing the strength of the balance sheet. But they forget that if the balance sheet does not remain strong for a longer period of time then business is going to have a tough time into the future.

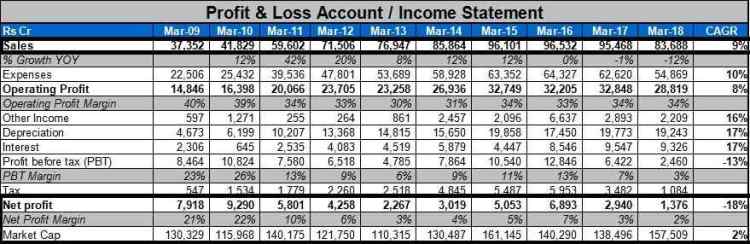

Accounting numbers, of course, are the language of business and as such are of enormous help to anyone evaluating the worth of a business and tracking its progress. Charlie and I would be lost without these numbers: they invariably are the starting point for us in evaluating our own businesses and those of others. Managers and owners need to remember, however, that accounting is but an aid to business thinking, never a substitute for it.

“What we learn from history is that we do not learn from history.”

Any company’s level of profitability is determined by three items: (1) what its assets earn; (2) what its liabilities cost; and (3) its utilization of “leverage” – that is, the degree to which its assets are funded by liabilities rather than by equity. Great companies = Float + Investment + Cash with higher return ratio

If the choice is between a questionable business at a comfortable price or a comfortable business at a questionable price, we much prefer the latter. What really gets our attention, however, is a comfortable business at a comfortable price.

Buy commodity, sell brand has long been a formula for business success.

Capital-intensive business, look for PBT / interest cost rather EBITDA / interest cost.

When we are fearful with our investment decisions then we focus on the each and every aspects which can result in the erosion of the capital.

Mr.Buffett has taught us many concepts and wisdom which is essential to us while making an investment decision. I am hereby compiling all my learning from the letters of Mr.Warren Buffett. Also an evolution of Mr.Buffett from bargain to quality businesses.

For all in one learning from Mr.Warren Buffett’s Letters, Click here –> BIBLIOPHILE WARREN BUFFETT’S LETTER 1957-2017