WB Letter 1982

Mr.Buffett has mentioned characteristics of cyclical industries-

The product which can be differentiated and sell it by the branding of it then the company can able to earn extra from it. But the product where no chance to differentiate product then profitability is the major factor of market forces.

We cannot predict that when the cycle will going to turn, we cannot predict that when demand will overtake supply and prices of the commodity will start improving or supply increases much compared to demand and prices starts falling.

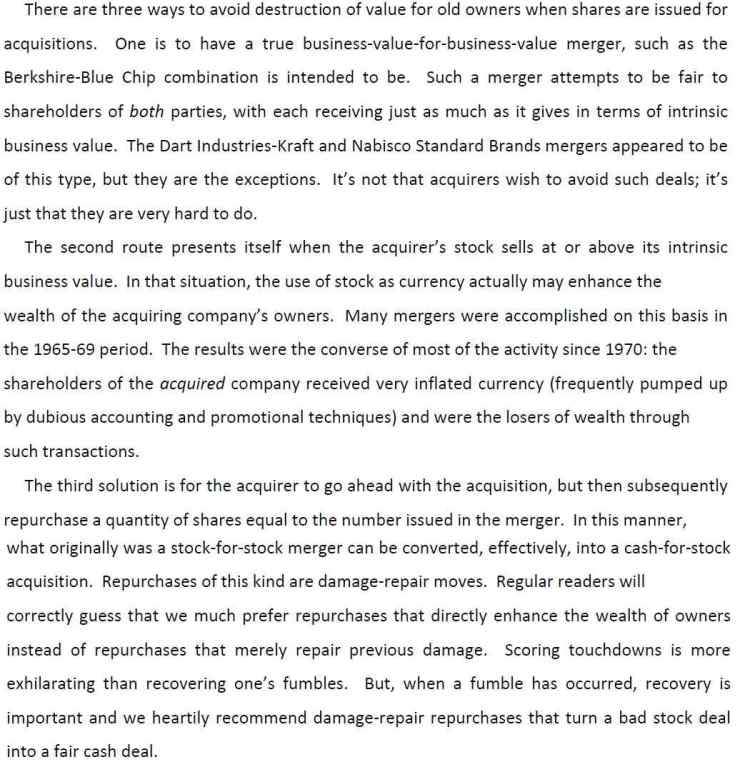

We should focus when any company is engaged in the corporate acquisition. If any company is issuing shares for the acquiring a company which having lesser intrinsic value then we should keep cautious. Such decision of the management provides us a clue regarding the perspective of the management and weather company is intended to create the wealth of the owners or not.

While management makes an acquisition at the expensive valuation by issuing their shares than some of the rationale given by management which we should check by putting highest cautions.

Mr.Buffett had provided a solution by which management can avoid value destruction for the existing owners of the company.

Many a time, management only focuses on the increasing future Earning Per Share (EPS) by sacrificing the strength of the balance sheet. But they forget that if the balance sheet does not remain strong for a longer period of time then business is going to have a tough time into the future.

The criterion which Mr.Buffett focuses while making an investment decision –

Warren Buffett’s Letters 1957 – 2012

Disclaimer: Businesses discuss in this article is not a recommendation to Buy-Sell-Hold. And I am not a SEBI registered research analyst.