WB Letter 1988

Borsheim’s

Berkshire Hathway has made an investment in the Borsheim’s which is a jewelry business in Omaha. This business is run by family members of Mrs.Blumkins (Founder of The Nebraska Furniture Mart). This business also getting managed by the people who have similar quality as Mrs.B such as an extraordinary combination of brains, integrity, and enthusiasm for work. All members of the Friedman family has been continued with the managing business as they were managing before Berkshire has acquired an interest.

Insurance business of the company remains in the pressure since long time and company expect to the float/premiums ratio to be at least three times in the year 1989 and 1990 with help of the team of Mike Goldberg, Ajit Jain, Dinos Iordanou, and the National Indemnity managerial team.

In the year 1988, Berkshire has made an acquisition of Coca-cola and Federal Home Loan Mortgage Pfd. (“Freddie Mac”).

Mr.Buffett had made an investment into one arbitrage situation – Rockwood & Co. when he worked at Graham-Newman Corp. Rockwood & Co. is a chocolate manufacturing company based in Brooklyn. During the year 1954, the price of the cocoa soared due to the temporary shortage.

Mr.Buffett give few points to keep in mind while making an investment into arbitrage opportunities-

Efficient Market Theory which is more in trend and many people believe that market knows everything. Yes, Market know many a thing which we also don’t know, but it is also a fact that many a time, the market also provides us an opportunities to make an investment which reward us in future.

Mr.Buffett also mentioned that if a market is efficient and know everything then he has not generated decent returns by investing into the various arbitrage opportunities. We also have seen wealth creation through investing into the equities and if market knows everything then few people are not able to generate good wealth. But with such arguments, we should not forget that market also knows many a thing and already discounted those into a price of securities.

WB Letter 1989

Borsheim’s – Jewelry business focusing more on the controlling cost and this cost control attracts more sales volume.

Berkshire has tripled advertising expenditure for the See’s Candies which reach the highest percentage of sales and which has converted into the good sales.

Coca-cola has started a new journey into the year 1981 with the appointment of the Roberto Goizueta as a CEO and Don Keough. Due to both, a product of the company started gaining momentum and sales has been started improving. They transform business in a manner which can benefit the shareholders.

Berkshire Hathway purchased preferred of the Gillette Co. –

As Mr.Buffett mentioned, we also need to look for the cover over depreciation as we look for the cover over the interest expenditures. Depreciation & capital expenditure is also a real expense, we can delay it but we cannot avoid it. If the company continuously keeps on avoiding capital expenditure then business will no longer remain into existence.

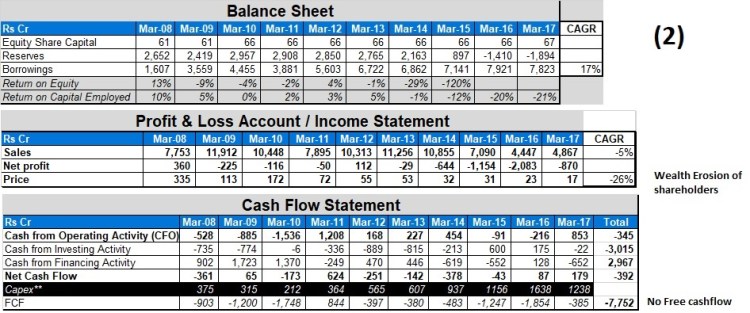

Low depreciation cover companies

We can see in above image that companies having a low depreciation cover then those companies need to bring external finance (Debt or dilution of capital) for expansion whereas those companies having a good depreciation cover then those companies do not need to bring external finance to fund expansion (repayment of debt or buyback of shares also can be done).

High depreciation cover companies

Mr.Buffett has mentioned his past mistakes for the review purpose. He believes that before committing a new mistake, we need to review our old mistakes.

We can learn and correct our mistakes from the learning from the mistakes of Mr.Buffett. These mistakes show us a transformation of Mr.Buffett from buying a “cigar butt” to a business which has an economic value.