When we have invested in the bonds then that will get little fluctuation to the market price. But when we have invested in the common stocks then it will have a wider fluctuation to the market price. So that we need to be ready financially and psychologically for upcoming fluctuation into our common stock investment. It is easy to advise for not doing a speculate but hard to follow it. Fluctuation and behavior of the market attract us to make a speculative decision. So, if we want to make a speculative decision then keep aside some amount of money as considering that we are going to lose it through speculation.

We need to take a benefit from the swing of the market pendulum rather than getting trapped into it. And we can take a benefit by way of timing to the market or through pricing.

We cannot predict the direction of the market consistently and if we start predicting a direction then we end up as a speculator, not as an investor. People want to buy during the bear market where everyone else is selling and sell during the bull market where everyone else is buying. But people are tending to do the reverse, the majority of the people buy at high / during a bull market and sell at low / during a bear market.

Similar has happened during the year 2017, people have seen a bull market from the year 2014 to 2017 and they started believing that this will never be going to end and stock prices keep on going higher and higher.

1st, 2nd and 3rd point has been explained to the previous articles of the same series.

One of the optical and data networking products company

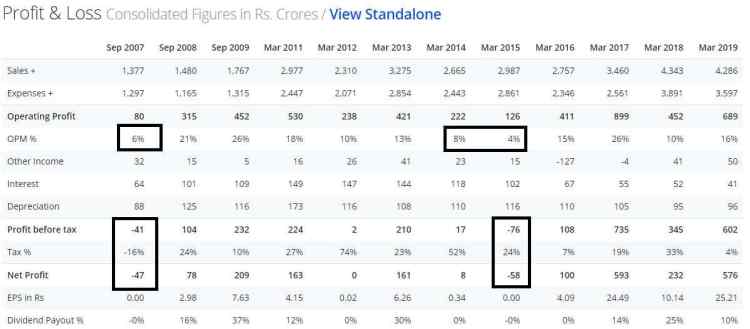

IPO of the company came at Rs.257 so that MCap was ~Rs.2367cr which was at the EV/EBITDA of 14.09x in FY17 and stock price rose to ~Rs.437 in FY18 which was at EV/EBITDA of ~26.33x. The company has incurred losses in a few years and came to profit since FY2016.

One of the publication company

The IPO of the company came at P/E of 33x and EV/EBITDA of 16.59x.

Day-to-day or month-on-month fluctuation to the market does not make investors richer or poorer. But what will happen for a longer period that will impact the wealth of investors. We need to keep distance ourselves from the crowd rather than go with the crowd. Also, we need to focus on emotional stability over an investment journey which helps us a lot. The normal investor gets trapped with greed as the market starts advances, but at the same time, intelligent investors booked a position of overpriced issues and parked those funds to bond, he will re-balance his portfolio.

Owning a common stock means we are a part-owner of the business, but due to the advancement of the stock market operation, investor’s mind gets diverted and they are getting more engaged towards the stock prices. They forget that stock price fluctuation should not be focused but they have to focus on the value of the businesses, quality of the businesses and progress of the businesses. Stock prices bring distance between business and us. If a person is making an investment for a longer period, but getting fluctuated as stock prices get fluctuate then he does not know for the emotionally stable and matured investors. Matured and intelligent investors do not focus on the price quotation every second but they focus on the underlying business. As businesses show successes it becomes popular among the people and it will command more premium, its mood swings with the market, etc.

We need to focus on earning the power of the business with the asset value of the business. But we should avoid paying higher to the assets as well as to the earning, otherwise, we need to be stay affected through the market fluctuation.

One of the telecom company

(Source – Thoughts on Thoughts blog)

The company looks very cheap based on the financial metrics and assets base, but if someone who does not have paid attention to the business of the company and earning the power of the business then—

One of the gelatin company

The company has some uncertainty and raw material problems but having a stable business. The company was traded at ~Rs.66 cr of MCap with having investment + cash on the balance sheet was worth of ~Rs.70+ cr so that entire business was available at free due to uncertainty. The company has delivered a decent return with also deliver Rs.10/per share as a dividend.

Few critics of value-based investing tell that such an approach does not work with the listed companies due to the ample amount of liquidity available. Such liquidity and stock market platform provide a daily opportunity to the participants to make changes to their holdings.

Many a time, Mr. Market ready to pay overpriced for the business and sometimes, He is ignoring too few of the businesses. We need to stay away to getting trapped from the Mr. Market mood swings. Mr. Market also behaves like a human being because prices of it and the behavior of it direct through human involvement as a market participant. We need to control our emotions based on our experience and belief over a while. We should stop overpaying attention to the market.

If we are doing a business then daily price fluctuations will not be going to disturb us and we do not make a change to our holdings. Price fluctuations only provide an opportunity to buy a business at a favorable price and sell when Mr. Market shows a higher price of the business.

The main distinction between speculators and investors is their attitude towards the market. A speculator is willing to make profits by way of market fluctuations whereas investors are willing to hold security at a suitable price and market fluctuations do not important for them. Market prices are just for our conviction so that taking benefits of it or to ignore it depends on us.

Stocks or a bond, the Market price will remain to fluctuate over a longer-term period. Good company with good management gets recognition into the good market price and bad management will get bad market price recognition.

Mr. Graham has explained the liquidity concepts which is suitable for the current scenario. The fund manager purchases few stocks for the portfolio, then the market starts moving upwards which attracts the investors to put more money. Now, due to the additional fund inflow, the fund manager has to buy a similar stock to the additional fund which brings stock prices to the dangerous level. Now, as the market falls, investors ask for the withdrawal of the fund and fund manager has sold out stocks to make the payment which leads to further fall to the stock prices. So here, they buy at high and sell at a low price. Our brain makes a pattern that similar has happened during the last time so it might be going to happens now also. And many times, our brain creates a pattern when there is not the availability of any pattern.

What we should need to do for the better than average return –

Our behavior is most important to get an above-average return. By controlling ourselves, we can stop ourselves from becoming our enemy. When we have made any prediction and that proven right then we become addicted to own predictions.

Disclosure – Companies mentioned in the article are just for an example & educational purpose. It is not a buy/sell/ hold recommendation.

Read for more detail: The Intelligent Investor by Benjamin Graham, Jason Zweig