Warren Buffett’s Letter 2013

Mr.Buffett has mentioned that they have made a repurchase of Berkshire shares during the year 2012 which enhance intrinsic value per share and that provides a benefit to the shareholders who are continuing with the company.

Examples of Buyback – SIMPLE IS BETTER – ISSUE -13 – BUYBACK

Mr.Buffett on the Heinz investment –

I learn investment to fixed income instrument from my Guru. ZEE Entertainment has issued preference shares to the equity shareholder of the company with the condition to pay 6% interest payment and redemption of principle starts from FY18.

Preference share was available at Re.0.80 and face value of that is Re.1.00. If we consider total cash inflow to us in form of interest payment + principle repayment then we can able to earn ~10.75% IRR for the FY14-22. Here, the present value of all future cash inflow @ 10.75% is Re.0.80 which is also higher than our purchase price which indicates safety also.

NTPC has issued debenture to the equity shareholder of the company as a bonus with the condition to pay 8.49% interest payment and redemption of principle starts from FY23.

Debenture was given as a bonus and ex-date of debenture was 20th March 2018. If NTPC was purchased on 18th March 2015 then price of NTPC was ~Rs.153.74 (with brokerage + other charges) and if we sell NTPC on Ex-date then price of NTPC was ~Rs.144.70 (with brokerage + other charges) so that cost for getting bonus was Rs.9.05 and the face value of that is Rs.12.50. If we consider total cash inflow to us in form of interest payment + principle repayment then we can able to earn ~14.02% IRR for the FY15-25. Here, the present value of all future cash inflow @ 10.75% is Rs.10.90 which is also higher than our purchase price which indicates safety also.

In both the cases, the interest rate on risk-free investment was ~8-9% and we are getting higher return compared to it.

Mr. Buffett on investing –

During, the year 1973 to 1981, farm prices had a bubble situation. When the bubble burst, then leverage farmer and lender both had a troublesome time. And after that Mr. Buffett had made an investment into the farm.

Mr. Buffett also made an investment into the other commercial property.

Mr. Buffett has explained investing lessons –

In our investment to stocks, we are get affected with the stock price fluctuation and listen to the pundits for their comments. Due to such habits, we cannot sit quietly with our investment and we end up with little or no return. Mr. Charlie and Mr. Buffett always made an investment as they are buying an entire business. They check whether they can estimate future five years of earnings or not. If they can estimate earnings then check whether available at a reasonable price or not. If either of the condition does not match then they move on to the other prospects.

For non-professional investors, they can make an investment into the index fund and accumulate it over a period of time.

Warren Buffett’s Letter 2014

![]()

Mr. Buffett mentioned Investors behavior which affects the investment return –

Unexpected behavior from Stanton in the year 1964 –

Why Mr. Buffett has bought Berkshire Hathway at the year 1962 –

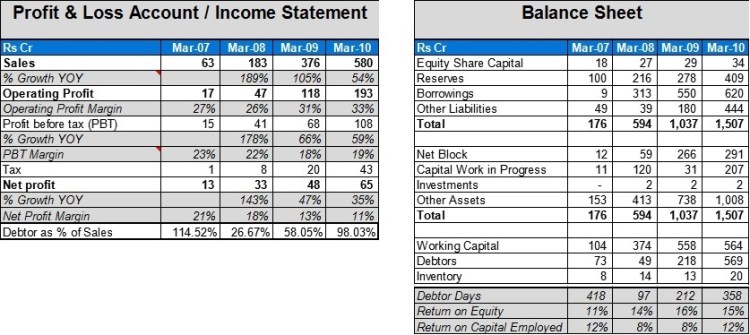

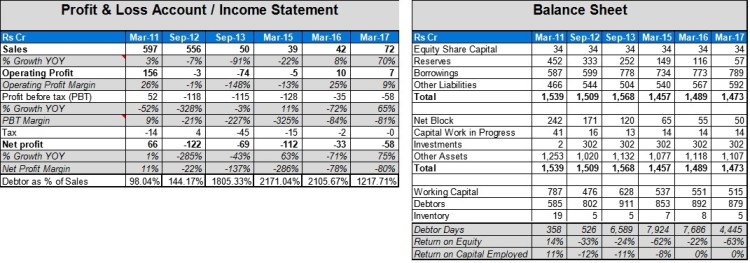

Example of Indian companies

One of the air-cooler manufacturing company of India was available below the book in the year 2009

One of the two-wheelers and commercial vehicle manufacturing company was available below book value in the year 2008 and below cash in the year 2008 and 2009

Charlie Straightens Me Out

The initial period of years, Mr. Buffett engage in the buying bargains (cigar-butt) strategy which he learns from Mr. Graham. The major weakness of the concept mentioned by Mr. Buffett is “Cigar-butt investing was scalable only to a point. With large sums, it would never work well.”

Here, I have also made a blunder but luck by chance got saved.

Mr.Munger has an impact on Mr. Buffett which has helped to Mr. Buffett to evolve cigar butt strategy to wonderful businesses at favorable prices. Many times, Mr. Buffett and Mr.Munger do not get agree but they never ever have made any arguments. When such scenario arises then Mr. Charlie end up a conversation with saying “Warren, think it over and you’ll agree with me because you’re smart and I’m right.” Mr. Buffett has accepted that transformation was not easy but he has done it.