The sixth part of Series “Once a darling, now an evil”. This series is based on the companies which were once upon a time darling of the market and now, it has wiped out the majority of all those gains. I am trying to put some of the number-crunching facts by which we have identified ongoing issues in the companies and have saved our wealth.

I am starting this part with one of shipbuilding and ship repair company which has an all-time high price of ~Rs.992 in 2008 and now last traded price at Rs.1.20.

On the first instance this company having huge sales and profit growth. This creates a temptation to buy with missing out of the opportunity.

Also, when we look at the terms of trade (i.e. debtors to creditor ratio)

Wonderful… should buy it immediately….

But when we go for deepen….

Payable is growing rapidly and it was higher than total expenses. This creates a sense of cautions that which vendor allow to keep this long credit? Also, if the company is capable to pay then why the company is not paying dues?

When we look at the Inventories, then inventory as a % of sales is higher than the sales. Means company has a good inventory pile up. Also, inventory days are above a year.

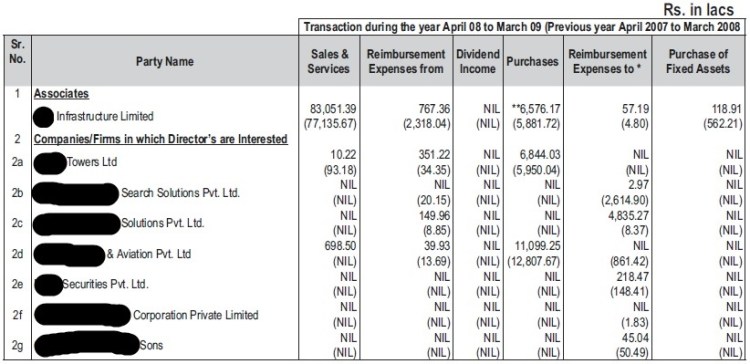

Now, when we look at the common size balance sheet of the company than almost 89% of the balance sheet was in other assets in FY06. It makes me curious that whether it is a manufacturing company or an NBFC. If we go for a breakup of those other assets then the majority of the part was in inventories and remaining? The remaining part was in loans and advances. I don’t have an old annual report but when looking for the FY10 annual report then such things get cleared. That was almost 25% of balance sheet and ~40%+ of other assets in FY10.

The company also has understated its depreciation. If we compare the depreciation rate with the peer companies then peer company has an almost double rate then the company.

If we look at the taxation as per the Cash flow tax rate then it is substantially lower this creates a doubt that why to pay less tax than actual payment. There can be possible to have an artificially boosted profitability in the P&L account.

Disclosure – Companies mentioned in the article are just for an example & educational purpose. It is not a buy/sell/ hold recommendation.

Like this:

Like Loading...

![]()

![]()