This article born at the train yesterday when I was coming back to Surat from Mumbai after attending wonderful seminar of Dr. Vijay Malik Sir. A good utilization of spare time which I got at train.

Yes, there are some of the similarities between our life and stock market or equity investment. Our life is as similar as we make an equity investment.

I basically try to encourage equity investment and sharing my learning in simple manner as much as possible.

As I always consider our life and equity investment in a similar manner. But I got inspiration to write this post from article (15 unknown flops of successful people) which I read few days back.

From that article I inspire to connect dots and try to explain that our life is as similar as an equity investment.

So how there is a connection between Human Life and Equity Investment????

Let me take examples of few successful persons.

1) Steve Jobs

One of the person whose life has impact on my life. We know him today as a very successful person but have we check that how was his earlier life when he was struggling.

In today’s world, we known him as a highly successful person but in his previous life, he also got many shock. And he fights against those shocks and run for his dreams.

We never try to focus on the pain which any successful person faced.

Let me take one another example of our most favorite person in the investment field.

2) Warren Buffett

We currently seeing him as a very successful person. But what about the pain he faced in his earlier life.

You all might thinking that at investment blog why I talking about philosophical talks. So let me give you an examples of few successful stories from our investment world.

1) Infosys

We everywhere found that Infosys is one of the biggest wealth creator. But my dear friends have we check pain which company faced at different phase of its life cycle.

IPO of company got withdrew from market due to not reached at minimum subscription. Anyone had an idea at that point of time about the company which rejected by everyone and that becomes biggest wealth creator.

If we look at above chart of Infosys, then we can come to know that many a times price of the stock goes down with many of reasons such as IT bubble burst, 2008 crisis, Narayan Murthy resign, etc.

2) Wipro or Eicher Motors

See the wealth creators, all stocks having some down moves in stock prices. That can be with any of the reasons such as global crisis, recession, internal problems. But the good company with good jockey can come out of from all such problems and able to create wealth.

So try to connect dots with my above example of Steve Jobs and Warren Buffett with this stocks stories.

Do you able to make sense?

Let me explain my view point. The people who got failed at some point of time in their life but becomes huge successful by fighting against their failure.

As same as many good companies facing trouble at some point of time and try to fight against those problem and try to come out of those problems.

If we have make an investment in such a good companies our life also become successful.

Just leave these big names; highly successful people and put ourselves in place of them.

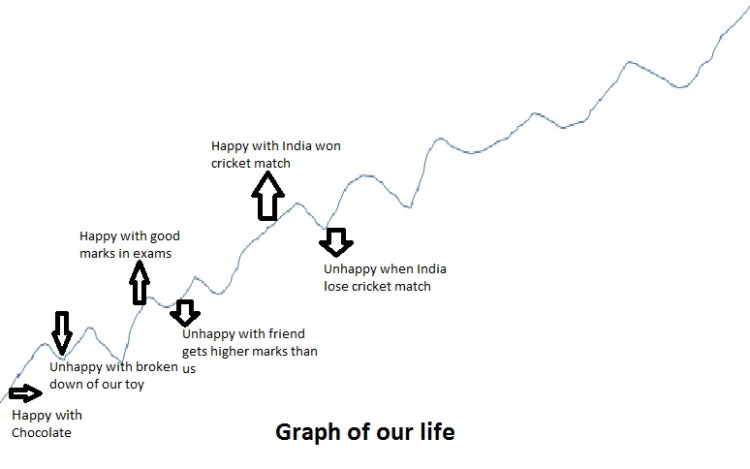

We also faced many problems in our life. From our childhood to our current life. Every day we are facing many events. Some events make us much happier and some make us unhappy.

So with happier events graph of our life goes up and with unhappy events graph of our life goes down.

So as similar as daily movements in the stock price. When we are not focusing on our own daily behavioral fluctuations then why we are much seriously focus on daily price fluctuations of the company???

As with the unhappy moods, we don’t stop living our life then why with some down price moves, we ready to take an exit from our stock investment???

As we are comparing our life’s progress at some intervals as similar to that we should compare performance of the company at some intervals rather focusing on daily price moves.

If I try to put our minutes to minutes’ behavior in graphical format, then it also looks as similar as price moves of the stocks.

Then why we are not ready with similar kind of behavior with stock investment.

We are not feeling risk by making many decisions related to our life but feel risk when it’s comes at an equity investment. What a funny behavior!!!!

According to me, actually our behavior having much more fluctuations compare to fluctuations in stock price.

The main problem is that we are not focusing on fluctuations in our life.

We take monetary fluctuations at a more serious manner then fluctuations in our own life.

So my purpose of writing this post is that equity investment is also as similar as our life which we are living. Thus, handle it as similar as we are handling our life. Also provide time to your investment as time we are living our life.

If we are ready with providing other chance to our life, then should also be ready with same kind of behavior with our equity investment.

But in actual manner, we are not doing it. We focus on very smaller fluctuations and make our decision based on those smaller fluctuations.

If we think on a longer horizon, then might found our such behavior as a very foolish.

So now at last conclusion time I just want to mention that as we provide motivation to our life when adverse events happened with us as similar with the equity investment, we should try to add additional fund when good company facing adverse time in form of motivation.

This additional motivation creates real difference and that decides rather we become successful or meet failure. Rather we become another Steve Jobs, Warren Buffett, Bill Gates, Henry Ford, Richard Branson or die as an unknown personality. As our investment becomes successful or we just become spectacular to watch wealth creation by other people.

So treat our equity investment as similar as our life and keep motivate our investment with additional funds when we get an opportunity to build good wealth.

Bonus

Friends keep motivate our good investment not our bad investment otherwise at the end we keep facing problems.

Stay away with such a bad horse with bad jockey or else we have to suffer a lot.

And at last we regret on our own decisions.

Disclaimer: The stocks discuss in above article is only for an example purpose. This is not a recommendation to Buy-Sell-Hold. And I am not a SEBI registered analyst.

Like this:

Like Loading...