WB Letter 1983

Berkshire Hathway made an acquisition of majority stake into Nebraska Furniture Mart. Mrs.Blumkin leave Russia for America when she was the age of 23. She had no formal education, no knowledge of English.

Many retailers had pressurized to the furniture and carpet manufacturers to not to sell products to Mrs.B but Mrs.B has managed to run her business and also able to cut prices. She has to face many cases but she won all and received huge publicity.

Mr.Buffett has explained the concept of intrinsic value in a very well manner.

Mr.Buffett has explained how to look at the economic Goodwill with the example of the See’s Candy. He has an emphasis more on economic Goodwill rather than accounting Goodwill. Company’s ability to produce a higher return on assets compared to market then that excess return is economic Goodwill.

Also mentioned that assets heavy businesses require additional capital for the further growth.

Great business creates a fortune during an inflationary year where the company requires less tangible assets. And also companies having availability of the fund for acquisition of the new business. They do not have to depend on the bringing additional fund by either debt or issuing new share capital.

I have quoted example of 2 two companies into the automobile business and one company is in the paint business.

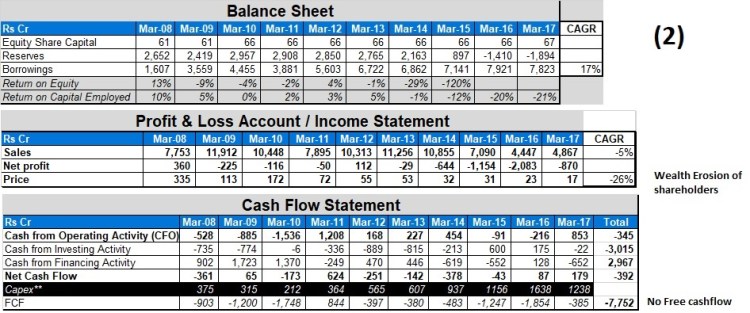

Example 1 – 3 which are asset heavy businesses, where we can see that borrowing is compounding, non-availability of free cash flow and wealth of shareholders does not created or get erode, whereas in example 4 – 6 which are asset light or least asset businesses, we can see that borrowing reduced or increased at a lower rate and investments into the books has compound well, availability of free cash flow which resulted into the wealth creation for the shareholders.

But the management who is not disciplined then they will do a silly things such as –

WB Letter 1984

Mr.Buffett has mentioned benefits of repurchase of shares.

Warren Buffett’s Letters 1957 – 2012

Disclaimer: Businesses discuss in this article is not a recommendation to Buy-Sell-Hold. And I am not a SEBI registered research analyst.