A security analyst has to deal with the past, the present and the future of any security issues. The analyst works on the understanding of businesses, financial strength, strong & weak points, possible risk, future earning power under the various scenario, etc. after all works, he decides whether to invest in the given security or not. We do not always rely on past performance, but for selecting the growth stocks, we need to value a future earning power and growth rate. Additionally, we should not forget the past performance given by the businesses for making a mathematical calculation of valuations. When we forecast for the longer future horizon then it will become the involvement of more errors.

Bond analysis

We need to focus on the safety, quality of the bond issue. And our prime criterion should be several times interest charges have been covered by the earnings currently. Cover on the average earnings of previous years and cover on the poorest earning year. As preferred stock dividend is not tax-deductible so that we need to check cover on PBT to interest charges + 2x of preferred dividend.

With the above points, we need to check the size of the company, (debt + preference stock)/equity ratio and property value. Now, if bonds passed through the stringent test and survived into the past performance then it has a higher probability to survive into the future. If the bond does not meet such criterion then it must be avoided though it offers a 2-3x yield compared to the risk-free rate.

Common stock analysis

Valuation of common stock needs to perform for deciding whether a common stock is attractive to purchase or not.

This means estimating future earnings and then multiplying it with the multiples. Multiple decided as the 1/expected earning yield. For example – if I expected to get 6% earning yield then my multiple would be 1/6% so multiple will be 16.67x. Different people provide different multiples and estimate different earnings which tends to a different price target for them. Why one company available at 10x of earning and other at 20x of earning? Do we pay rightly or paying overdue to a rosy picture? These all questions getting answered by the following factors –

Long term prospects – we cannot able to know that what will be going to happens in the longer future but then also, we try to estimate for the far future. This estimation creates a different multiple for the same stock. Also, need to check that whether the company is a serial acquirer or they make an investment to own company? If serial acquirer then what is the track record of previous acquisitions? Whether the company able to generate enough cash from operating a business or has to rely on other people’s money? Whether diversified customer base or rely on one single customer?

Does the company spend money on research & development, developing new products though they have a successful product? (R&D as a % of sales) and also how much company is spending on selling and marketing? (Selling & marketing, distribution spending as a % of sales)

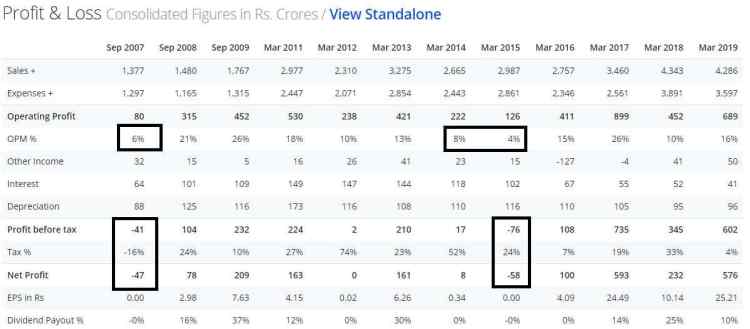

One of the Pharma company of India

A company having R&D and Selling spending combined account for ~16.73% of sales. Such spending improves the longevity of earnings. Sales and profit of the company have grown by CAGR of 17% and 26% respectively during FY12-19.

Management – we know that management plays an important role in the development of the business. And many a time, given weight to the management leads to overvaluation or undervaluation to the stock. If any business is continuously successful for a longer period then it will be considered as having good management. Does management has fulfilled promised made by them? How they behave while meet failure – they admit failure or pass responsibility to the economy, uncertainty, weak demand, etc.? Look at their behavior during the best period. Does senior management involve the frequent buying and selling of shares? Does management involve to direct the market speculation through announcement? Does the financial statement of the company is transparent?

All the above points provide a study of qualitative aspects of the management part. If we focus on the above points then we can avoid the management who is not shareholder-friendly.

Financial strength and capital structure – one company has an excess of cash on the balance sheet and another one has a bank loan + preference shares + bonds then we should consider the first one good compared to the second one though both have the same revenue, EPS, etc. Good business does not frequently require huge cash to run a business and they generate a good sum of money.

I am not quoting any example over here; I have already explained the same in Warren Buffett’s 2007 letter article. And many businesses pass and fail from the above parameters.

Dividend – consistent dividend payment is one of the criteria for judging the quality of the company. Defensive investors will focus on the consistency of the dividend payments. We also have to check that the company paying dividends out of free cash flow or from borrowings.

One of the steel manufacturing company

There are few companies which are into the expansion phase then also paying out dividend by taking a debt and equity dilution rather retain cash for expansion. In such cases, we should not focus on the dividend. Also, if the company can grow with generating a good return ratio then we should prefer to retain cash for expansion purposes rather than the distribution of dividends.

One of the retail company

The company has good growth and over some time, the company has started generating a decent return ratio. Here, the company does not require to distribute dividends and retain cash for expansion of the business which the company is doing with zero dividend payout.

If the company does not have a growth opportunity and does not require to bring external funding to run a business then it is preferable to distribute earning as a dividend.

Dividend policy – how much company is distributing profit as a dividend, higher the dividend distribution higher the valuation the company gets. Here, we need to see that whether dividend serves the purpose of shareholders or retaining profits for future expansion serves the purpose. The company should buy back the shares when it available cheap, not when it traded at high/overpriced.

The capitalization rate for growth stocks

Value = Current Earnings * (8.5 + 2 * Expected annual growth rate)

*Expected annual growth rate would be considered as growth for upcoming seven to ten years

Industry Analysis

For making an analysis of any security, we need to check the industry growth, position of the particular company within industry, how industry will grow and earn profits, what was the past of the industry, what is present state and what will be the future state of the industry, what will be the new product and process.

For calculating the value of the company, we need to check how the company has performed into the past and what are the factors which can change the future performance of the company. Calculate valuation on the past performance and list down the factors which make changes to the valuation based on past performance. Also, mention points that can change the future performance of the company.

Disclosure – Companies mentioned in the article are just for an example & educational purpose. It is not a buy/sell/ hold recommendation.

Read for more detail: The Intelligent Investor by Benjamin Graham, Jason Zweig