WB Letter 1994

Mr. Buffett has mentioned that they are ready to wait for opportunities within their comfort zone. They do not like to capture each and every opportunity but want to capture an opportunity within their circle of competence. He added that they have picked up their best investment when some of the macro factors are at the peak. Here, we can also make an interpretation that we also can make a good investment when the macro is at the peak of worst situations such as 2008 global crisis, 2013 depressed economic growth with policy paralysis, etc.

Own investment approach

Book Value and Intrinsic Value

Mr. Buffett has explained how we need to look at the growing business in-terms of earning and not huge growth into the book value.

Berkshire has made an investment into the Scott Fetzer at the beginning of the year 1986 with having a collection of 22 business which is the same in the year 1994. They paid $315.20 million for Scott Fetzer which having a book value of $172.60 million.

Performance of the book value given by Mr. Buffett of Scott Fetzer –

We can see that book of the company has not grown but earnings of the company have grown approximate double. Also when Berkshire has made an investment into the company then the company has debt on balance sheet and in the year 1994, the company becomes virtually debt free. Return on equity has been improved well.

Intrinsic Value and Capital Allocation

Whenever merger and acquisition made by a management then they should have the focus that whether the intrinsic value of the company is increasing or getting diluted.

We need not make a difficult investment for getting a good return if we can able to analyze business which is easy to understand and its economic characteristic are long lasting then we can get a good payoff for our investment.

They also give priority to the existing investment rather buy a new investment. They compare that which investment opportunity is more beneficial to them.

Mistake Du Jour

Mr. Buffett has mentioned that purchasing a USAir in the year 1994 as his mistake.

WB Letter 1995

Acquisitions

Mr. Buffett has explained regarding acquisitions that when the company has a business which is performed sometimes and worsen at few times then we need to sell the business when it is performing well. Majority of the company doing same so that when the acquisition of any company happens then majority of the time acquiring company does not get a benefit. We need to carefully analyze that whether acquisition increases a per share intrinsic value for shareholder or not.

Examples of wealth destructor companies through acquisition

One of the medical device company which has done reverse compounding of the wealth of investors –

One of the wind energy company which has done reverse compounding of the wealth of investors –

Helzberg’s Diamond Shops

Helzberg’s Diamond Shops was started by the grandfather of Barnett Helzberg, Jr. In the year 1915 with a single store which has increased to 134 stores in 23 states. Sales had grown from $10 million in the year 1974 to $282 million in the year 1994. Berkshire has taken stake into the company in the year 1995.

R.C. Willey Home Furnishings

R.C.Willey is the leading home furnishings business in Utah. Bill Child, CEO of R.C. Willey has taken over the business from his father-in-law in the year 1954 when sales were about $250,000 and he put efforts which resulted into the sales of $257 million in the year 1995. Company accounts for 50% of the furniture business in Utah.

According to Mr. Buffett, Retailing is a tough business –

GEICO Corporation

Mr. Buffett has bought GEICO into his personal account when he was at the age of 20 years.

Float

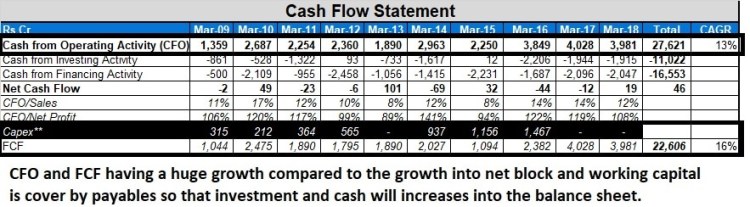

Berkshire has not only compounded business earnings but also compounded its float. Since the year 1967 to the year 1995, Company has compounded its float by the compounded rate of 20.7%.

Examples of the companies which generating 10%+ ROA and compounded float –

One of the automobile and commercial vehicle company which has created a huge wealth –

One of the automobile company which has created a wealth –

One of the FMCG Company which has created a huge wealth –

One of the Asset Management Company –

Charlie and Buffett believes to control being wrong and follow – “Just tell me the bad news; the good news will take care of itself”

Disney

The merger of Cap Cities into the Disney approved in the year 1995 where Cap Cities shareholders get a choice of cash or share of Disney (one share of Disney for one share of Cap Cities). Berkshire has selected share option for their 20 million of Cap Cities shares.

Mr. Buffett has been interested into the Disney since the year 1966 where Disney was available at ~23% of pre-tax earnings yield (23% = $21 million of pre-tax profit / $90 million of market value).

Berkshire always respects shareholders though they hold large size or small size.

Warren Buffett’s Letters 1957 – 2012

Like this:

Like Loading...