WB Letter 1992

Mr. Buffett has written that they own a collection of business which is exceptional and also a run by an exceptional manager which has resulted in the higher returns.

Nowadays I have experience that everyone is becoming a market expert and providing their view on the short-term direction of the market. For such people, Mr. Buffett has given a good quote –

The Salomon Interlude

In 1991, Salomon Brothers caught for bond trading scandal and Mr. Buffett has performed as a chairman of Salomon for the ten months to resolve a problem at Saloman. At Salomon, they have been submitting false bids in an attempt to purchase more Treasury bonds than permitted by one buyer during the period between December 1990 and May 1991.

Five authorities – the SEC, the Federal Reserve Bank of New York, the U.S. Treasury, the U.S. Attorney for the Southern District of New York, and the Antitrust Division of the Department of Justice – had important concerns about Salomon.

Acquisitions

Many acquisition-hungry managers made an acquisition with the hope that they will transform business which will provide them with a good opportunity to earn. When a manager gets failed, they learn a lesson but shareholders pay fees for selecting them as an investment candidate. Mr. Buffett has accepted that during his earlier career, he also has made an acquisition but he able to achieve success due to cheapness into acquisitions and some of the acquisition got failed also. And due to such mistakes to get a failure, he revised his strategy to make an investment.

Berkshire has made an investment into the Central States Indemnity which is an insurance company provides an insurance to the credit-card holders who are unable themselves to pay because they have become disabled or unemployed.

H.H.Brown, a Subsidiary of a Berkshire has made an acquisition of Lowell Shoe Company which is into the manufacturing of the shoes for nurses, and other kinds of shoes as well.

Mr. Buffett has initial thought of purchase General Dynamics for the tendering stocks to the buyback and earns a small profit in short term. But Mr. Buffett began to study the company and he found that Bill Anders, CEO of the company has performed a decent job to run a business. Mr. Buffett has dropped the idea of buyback opportunity and decided to become a long-term investor of the company.

Investing strategy of Berkshire has been little change and also Mr. Buffett has made some compromise on the price to purchase a business’s due to market condition and their increased size.

Now, how to know an attractive price? Mr. Buffett has explained that we look attractive price with the framework of value or a growth investor – what we consider to ourselves. He explained that growth is always a component of the calculation of the value of any company. He mentioned that people using value investing term everywhere with the paying higher price then calculated the value in the hope that someone pays higher to purchase an asset from them. But such activities do not consider as an investment, it is a speculation.

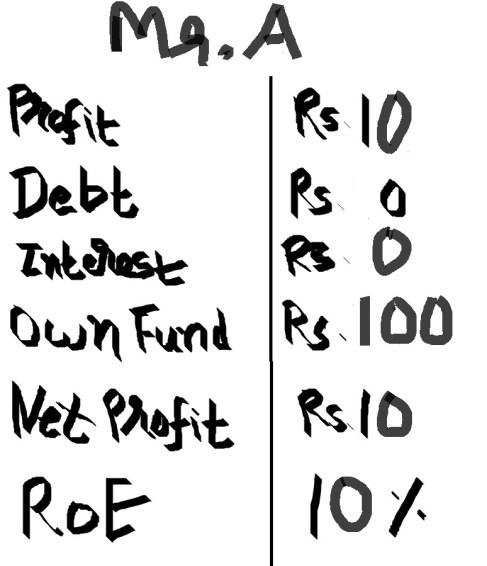

People consider value investing where attribute such as low Price – to – Earnings ratio, low Price to Book Value ratio or high dividend yield or combination from mentioned and not consider value investing where reverse attributes are available. Many a time, business growth also tell us little about the value but it is also true that often growth has a positive impact on the value. We have to analyze that whether a business can able to generate a good return on the incremental invested capital or business generating a low return on incremental capital. Former one provides the benefit of growth to the investors and latter one hurts to the investment.

Ex – Value Trap

Taken from Thoughts on Thoughts blog

The company looks very cheap on the basis of the financial metrics, but if someone who does not have paid attention to the business of the company then—

An investor has lost his capital also. So, that in value investing also, we cannot escape from the future. (For detail article, Kindly visit – http://neerajmarathe.blogspot.in/2010/04/mtnl-value-trap.html)

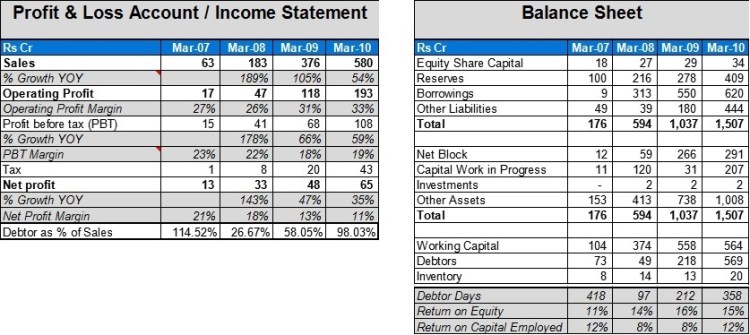

Value Trap – One of the educational providing company which fall under the criteria of value investing –

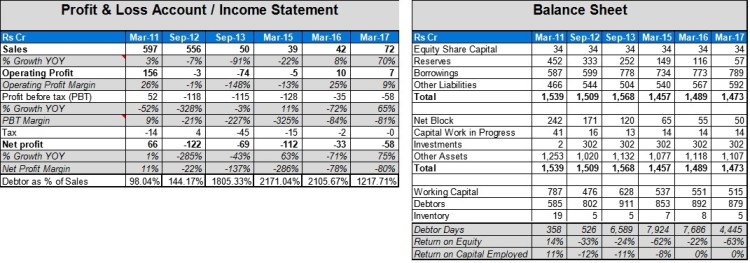

The company is not able to generate good growth in sales and in the profitability but investment and cash have grown well. Also currently the company is available below cash + investment which fall under the criteria of the value investing. But what about the growth into the business or on the survival of the business. Will be cash & investment remain with the company in the future? Lower sales, higher expenses, lower profitability and for last 3 years the company has stopped paying a dividend. Should we consider such investment as value investing or value trap?

Ex – Growth at the low return on capital companies

The company which is generating a good sales growth but they is not able to generate a higher return on capital they employed then those companies require to take debt or dilute an equity (in-short they need external funding). Investors in such companies will face difficult to create wealth or sustain wealth.

We can see that companies having a higher sales growth but cannot able to generate a higher return on capital then they require to bring external finance to fund the growth. The growth of such companies will extend for the long period but investors face difficult to create wealth.

Ex – Growth at the higher return on capital companies

Reverse to above if company having a good growth with having a higher return on employed capital then company does not require to bring external financing (if they having a borrowing or a dilution of capital then the size of it is very small in proportion) to fund the growth of a company and also investors of such a company can create a good wealth.

Ex – Higher growth but no value

If we just focus on the growth of the company and not on the quality of the growth then we need to lose our capital also.

A company having good growth but does it have a quality of growth?

More dangerous balance-sheet quality after FY2010 –

Every time does not value investing or growth investing provides a better investment opportunity but a rational combination of the both can be good investment opportunities.

Mr. Buffett has explained valuation matrix given by Mr. John Burr Williams which is determined by the cash inflows and outflows – discounted at an appropriate interest rate – that can be expected to occur during the remaining life of the asset. He has given matrix which similarly uses for bond and stocks. But bond involves fixed future cash inflow in-terms of coupon received by us and in equities such coupon is not fixed, we cannot say with surety about future cash inflow and outflow for business. Cash inflow and outflow into equities are highly dependence on the nature of a business, quality of management. For overcoming such problem Mr. Buffett uses two rules at Berkshire –

According to Mr. Buffett, new issue market is controlling by the stockholders and institution; also new issues come during favorable market conditions and we need to pay a higher multiple. Here, we are not going to get any bargain whereas in the secondary market, many a time, we get x value business at the 1/2x.