I am going to write something different which is not easily acceptable to our investment society. But if we analyze it thoroughly then we can understand it and able to accept the reality.

So before going forward with the core discussion, let me start with some basic concepts.

Let me first mention what is contrarian investing?

“Contrarian Investing is an investment strategy that is characterized by purchasing and selling in contrast to the prevailing sentiment of the time.” – Wikipedia

“Contrarian investing is the ideology in which an investor attempts to make profits by making his decision against the popular understanding but only when the conventional wisdom appears to be wrong.” – Trade Brains

After reading the above definition, we can come to know that contrarian means going against the herd. If we perform a task that is not performed by anyone then we fall into the category of contrarian person.

When it comes to an investment then What people usually do as a contrarian investing decision?

People run a list of 52 week low, the stock price has fallen a lot, low in valuation, companies having some problems & not with good financial but available as penny stock prices, etc. These things the majority of people are doing. I was in interaction with many of the clients and all those seek an investment idea with all the mentioned criteria earlier. In addition, they seek investment ideas where stock prices are below Rs. 5, 10 or maximum Rs. 100

A common myth in the market is catching a falling knife, turnaround, beaten-down stocks, etc. work as a contrarian. But if we check ground reality then the majority of people focus on those factors so if all want to do the same then how it can remain contrarian.

In addition, people average quality when stock prices start falling, the majority like to average at lower and booking profit when stock prices going upwards territory. They don’t have guts to book losses. Thus, lastly, they remain with the losers as they have booked out winners.

So, if the majority are performing in the same way then how it can be a contrarian investing?

I have taken a few examples of the companies which are having lower quality and prices have fallen. And as prices have fallen people have started accumulating those stocks. I have taken the last 10 shareholding patterns for reaching to a conclusion. All these people who have tried to catch a falling knife, those all have ended up with the losses.

We can see that people have to keep on buying as prices have fallen, book value bargain, try to catch a falling knife, averaging lower, etc.

So, what can be a contrarian investing?

When I asked people to invest in XYZ company and stock prices trading near 52 weeks high then people tell me that it’s already run up, give me something which has not run.

Also, stock prices are above Rs. 1000, 5000, etc. then they fearful and ask for a penny.

Means buying stocks which are traded at 52 weeks high then people tend to stay away from it. In addition, when stock has moved upward and things have improved with it then we never have to hesitate by averaging upward. We need to book losses if things are not happening as per our assumptions and keep running profitable ideas.

“Cut the losers and stay with the winners” – it’s the only formula of staying with a portfolio of winners.

So, these all can be a contrarian where the majority of people don’t focus.

Mr. Nooresh Merani has twitted a few days back –

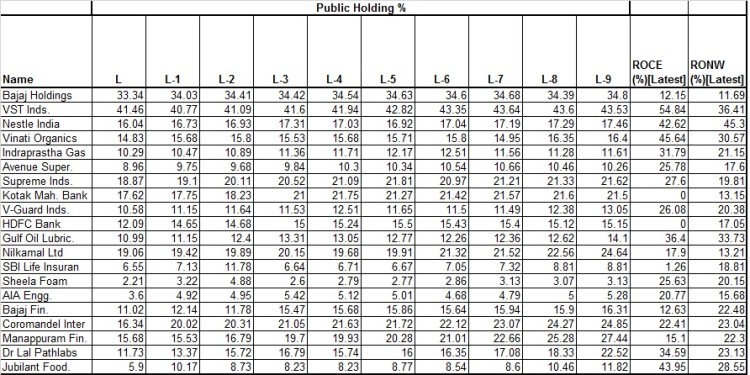

Similarly, I have taken a few examples of the companies which are having a decent quality and prices keep on rising. And as prices keep on raising people have started booking profit in those stocks. I have taken the last 10 shareholding patterns for reaching to a conclusion. All these people who have to try to sell out their positions, all have ended up with the regrets.

We can see that people don’t like to average upward when companies having a quality, they run for booking profits when the stock price has moved up rather keep holding a winner. So that what the majority are not doing that only can provide us with an above-average return.

It is not always one asset class; one investment style remains contrarian forever. As particular assets or investment styles generating above-average returns then that will attract more and more participants which convert contrarian style to general style or asset class. When equity becomes popular among the participants then it having a good probability of underperformance compared assets class which is relatively lower popular. So that we require to shift from asset class as it moves in the pendulum of unpopular to highly popular.

This is the only concept of contrarian investment that teaches us. But the majority of investors have taken this in a different way. And they try to hunt for the lower value, falling knife, etc. Yes, this can be a contrarian investment style but we have to compare that when the majority of the people interested in such situations then that will not remain contrarian any longer.

The majority of the time, investors avoid higher value, quality, keep upward-moving stocks and that can be a contrarian investment strategy for us till people not getting attracted to such quality companies.

So that there is not a single investment style or asset class which remains contrarian forever. It will be unpopular and will moves to popular and then again once in a while return to the unpopular. We have to identify it and that helps us to create and protect our wealth.

Disclosure – Companies mentioned in the article are just for an example & educational purpose. It is not a buy/sell/ hold recommendation.