When a panic situation is everywhere people got trapped with fear emotion. We cannot see the cheaply available investment avenue if we cannot think with rational thinking. During such a period, a person who has control over emotions has financial intelligence then he can establish a business and expand it with little effort.

If we have read, having financial intelligence, control over emotions then we can say that time will change but history repeats itself.

Every bull phase has many financial heroes and when it burst, the majority of heroes becomes a villain. So, we have to put lots of care before admiring any of the heroes of a particular time.

An employee has to first pay tax from income that is income – tax then remaining for spending. While for businesses income – spending then remaining for tax.

While governments would like to take more money from corporate bodies, they realize that if they pass abusive tax laws, the corporate bodies will take both their money and their jobs to some other country.

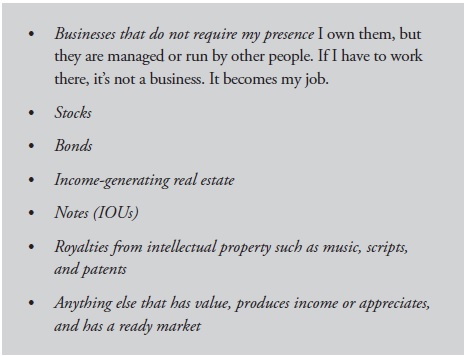

We need to focus on increasing an asset on the balance sheet. This we cannot do in one go. We can slowly and steadily acquire assets without getting over-leverage and without taking additional risk.

Start small, and take your time. Experience is more important than money.

We need to transfer our thoughts process from “I can’t” to “how I can do it”. Then we can see that the results get started. But it’s not an easy and short process. It will take time and effort to change the thoughts. Another point is when we are working for being “B” and “I” then we need to focus on understanding laws and take benefits from them.

We should focus on reading history and try to learn from it. So that we can understand the cyclical nature of any market. And we can take benefits of those nature.

We have two choices, either we can choose security or freedom. If we go for security then we have to pay a huge price and taxation. If we go for freedom then we can learn to play this game and can play it wisely.

Read for more detail: Rich Dad’s Cashflow Quadrant: Guide to Financial Freedom