Few investors require an expert to suggest to them what to do, when what kind of decision requires to make, etc. They entirely rely on the expert. So that if they have made a mistake for choosing their expert then their chance of winning get reduced and sometimes, very less chance or increases in the chance of losing. They are financially uneducated and not interested in investing in learning financial education which makes them helpless to rely on so-called experts.

Few are those who interviewed many stockbrokers, advisors, before making any investment decisions. They are busy with their works and do not find time to gain knowledge. So that they would like to delegate their investment decision to those who are good at it.

And remaining having a good knowledge about investment which help them to make more wise decision with their investment without relying on others.

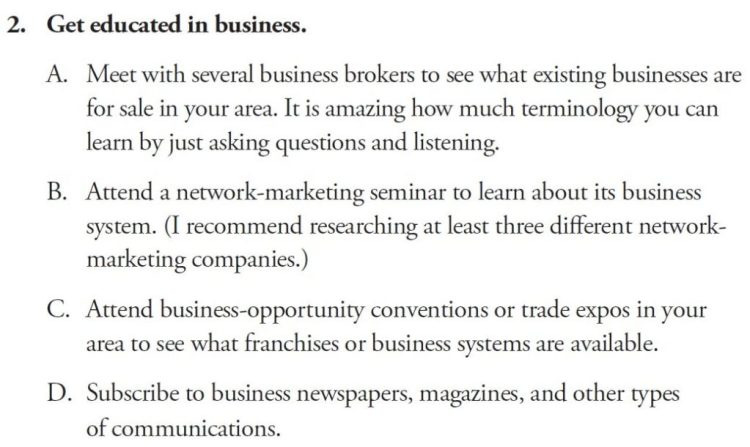

For gaining a good grip into the B and I quadrant, we learn to solve bigger financial problems. We try to be a good business owner because a good business owner can understand the business part well and also has an excess cash flow to invest. If we do not have a proper financial education then we can do a blunder in the I quadrant. So that financial education is key to making a wiser decision as well as avoiding blunders.

Read for more detail: Rich Dad’s Cashflow Quadrant: Guide to Financial Freedom