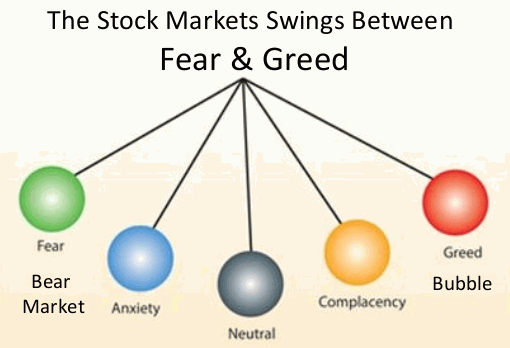

As we have seen to the previous articles of the same series that common stocks have the advantage to beat the inflation and given an income in the form of dividend and price appreciation. But we also have to keep in mind that common stocks become riskier if we bought it at a higher price. If we consider the period of the year 1929 then it has taken 25 years to break the market level of the year 1929. and we need to keep such a scenario in mind while making an investment decision. Such a scenario is more difficult and riskier compared to the bond investment. This scenario becomes difficult to survive if the focus does not have on the risk control.

The criterion for the selection of the stocks for the defensive investors are suggested by Mr. Graham

- Investors have made a diversification between 10-30 stocks of the portfolio

- Selected companies should be large, prominent, and conservatively financed.

- Long track record of dividend payment.

- Price multiple limits – multiple should not be higher than 25x of average earning of past seven years and multiple should not be higher than 20x of TTM earning. Such criterion removed growth stocks, popular stocks, etc.

Growth stocks to consider which has given a decent earning growth during the past period and also a similar growth will be sustained to the future also. As growth stocks have a long track record of the decent growth which will attract a speculative nature and increases a higher multiple. Such higher multiple can drop as earning growth fall, earning falls, etc. and that proves dangerous for the defensive investors.

One of the Air Cooler company of India

As we can see that the company has posted the lowest growth in March-18 since the year 2010 and due to the lowest growth, P/E multiple of the company has fallen from around 89x to 32x.

After the selection of the common stocks to our portfolio, we need to keep track of the particular common stocks for checking whether the improvement of the business, financial or not.

Mr. Graham has also appreciated the systematic investment plan for the index fund which can be helpful to investors for the 20+ years.

We have seen to the last article of the same series that allocation of the capital between common stocks and bond depends on the individual situations. When a person needs money to run his family with no further income sources then he must deploy 75% fund to the bond. Also, investors should allocate fund as per their knowledge, experience, and temperament which is a fortune creator to the investment field.

People get confused for the risk with the fluctuation in the price of the particular common stocks. But we should take value rather than consider a market price of the particular common stock. If value, quality of value is getting deteriorate then it is a real risk for us. And also, if we have paid an excessive price for the common stock, then that invite a loss to our wealth. We need to buy common stock at a price which provides further growth to the future.

If we make a thorough analysis and keep the focus on the safety of capital then deploying money to the common stocks becomes as easy as we put money to the bonds. But when people have lost their money during the crisis, they do not believe that common stock investment also can be safe & help us to create wealth.

Mr. Lynch has mentioned that we should buy common stock of those companies of which we are using a product or we understand the business. Also, he mentioned that though products of the company are successful and we all are using it, we need to study the financial statement of the company and estimating the value of the particular company. Majority of the people forget to do a later part and just put the focus on to the first part of the saying of Mr. Lynch.

One of the specialty foods with branded rice manufacturing company of India

A company having a good brand for its products but its major fund gets stuck into the inventories and for that company requires to bring a borrowing. There are many examples where good products do not have rewarded as a good investment. So, there will be no alternative for hard work and analyzing financial statements.

Disclosure – Companies mentioned in the article is just for an example & educational purpose. It is not a buy/sell/ hold recommendation.

Read for more detail: The Intelligent Investor by Benjamin Graham, Jason Zweig