Before starting the article, let’s know about mentors, who is a mentor in our life, then we try to understand why we require a mentor in our life?

Who is a mentor?

A mentor is a person who can support, advise and guide you. – Guider

Why do we require a mentor in our life?

They typically take the time to get to know you and the challenges you’re facing and then use their understanding and personal experience to help you improve. – Guider

So, from the above definition, we can understand that we need a mentor in each area of our life from starting learning to walk in childhood to the end of life. Our first mentors are our parents then we learn from outside of the world.

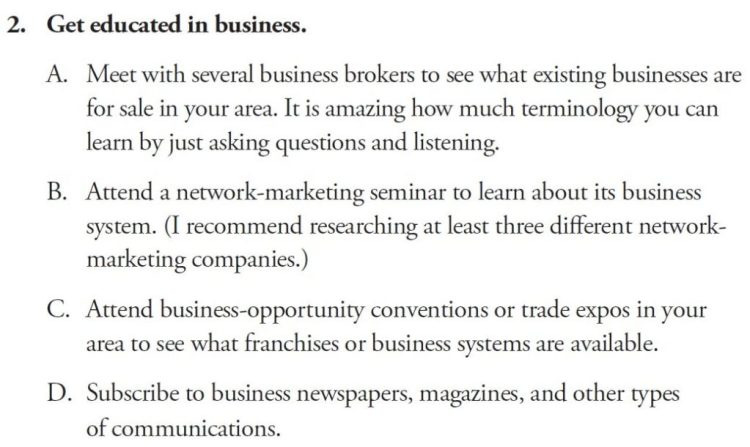

Similarly, financial education and growth in it require having a mentor. Mentors tell us what is right and what is wrong for us. They support us to learn about the B and I quadrant which helps us to become wiser and help us to make a rational decisions. He can guide us on building an asset column and generate more passive income in form of a dividend, rent, interest, etc.

As of now, we know that having a mentor in our life is important so that we have to be very careful with the selection of a mentor. The mentor should have already walked on the same path where we want to walk. “Professionals have coaches. Amateurs do not.” When we see a coach in cricket then coaches are those who have played cricket in their life, not those who have didn’t visited cricket ground even.

With having a mentor, we should have a reverse role model. These people teach us what not to do in life. They got broken down, stuck with debt traps, etc. so we should learn from them about what not to do. I have met both kinds of people. I have learned many things in my life from people who got broken in the investment field. I have prepared a checklist of what should avoid while investing.

The people with whom we are spending the majority of our time, are our future. If we want to change our future then we have to change that person with whom we are spending the majority of our time. Our surroundings have an impact on our thoughts processes and our decision-making abilities.

When we come to know about the person category, and we know our goal then we can change the group for our betterment. Also, we can join those who are similar to our goals.

If all person falls under the same quadrant where we want to go then we should be happy that we are surrounded by like-minded people. But if not then should think for change for the betterment of our journey towards financial nirvana.

Read for more detail: Rich Dad’s Cashflow Quadrant: Guide to Financial Freedom