The fifth part of Series “Once a darling, now an evil”. This series is based on the companies which were once upon a time darling of the market and now, it has wiped out the majority of all those gains. I am trying to put some of the number-crunching facts by which we have identified ongoing issues in the companies and have saved our wealth.

I am starting this part with one of the manufacturing, processing & trading of yarns, fabrics, ready-made garments and towels company which has an all-time high price of ~Rs.582 in 2008 and now last traded price at Rs.0.35.

On the first instance this company having huge sales and profit growth. This creates the temptation to buy with missing out of the opportunity.

But when we go for deepen….

Now, let’s look at the above data then though the company has good growth in sales and profit but not able to generate CFO. This will require to bring external funding in terms of equity and borrowing, and both have increased rapidly. Look at the receivable and inventory as a % of sales than 73%, 69%, 70% in FY08,09,10 respectively. Also, if we look at the debtor days and inventory days both are increasing rapidly.

If we look at the taxation then as per the Cash flow tax rate then it is substantially lower this creates a doubt that why to pay less tax than actual payment.

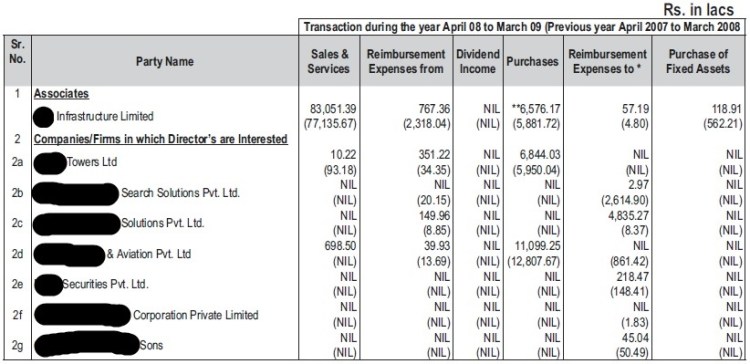

Also, when we look at the investment than the majority of the investment made in subsidiaries.

Disclosure – Companies mentioned in the article are just for an example & educational purpose. It is not a buy/sell/ hold recommendation.