The 13th part of Series “Once a darling, now an evil”. This series is based on the companies which were once upon a time darling of the market and now, it has wiped out the majority of all those gains. I am trying to put some of the number-crunching facts by which we have identified ongoing issues in the companies and have saved our wealth.

I am starting this part with one of the company is in the business of manufacturing and trading of iron and steel products which has an all-time high price of ~Rs.443 in 2012 and now last traded price at Rs.1.59.

In the first instance this company having a huge sales growth. But PAT has huge volatility.

So, we go deeper ….

Here, we can see that debtor day and inventory days are growing rapidly and assets utilization & return ratio are falling.

I would like to go further detail of it.

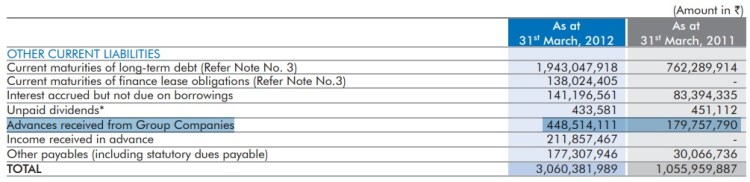

Here, we can see that CFO is very volatile with cumulative CFO of FY09-12 is Rs.-20 cr whereas cumulative PAT is Rs.88 cr so that CCFO<CPAT which indicates that the company has a working capital issue which we have seen in debtor days and inventory days also.

The company shows good depreciation cover because of the capitalization of assets. One can improve depreciation cover either through improving EBIDTA or by reducing depreciation. If an asset is capitalized then it is not expensed in the same year the asset is purchased. So that here the company has selected to reduce a depreciation.

Actual Journal entry of depreciation

Depreciation A/C Dr

To Accumulated Depreciation or Fixed Assets A/C

Here, depreciation charge at income statement which will reduce the bottom-line of the company. And also added to the accumulated depreciation or directly reduces from the fixed assets so that value of fixed assets gets reduced.

But what happens when the company has decided to go for capitalization of depreciation

Fixed Assets A/C Dr

To Cash A/C

Here, the value of fixed assets gets increased rather than getting it reduced and cash will directly getting reduce with that amount. The income statement does not have any impact it which resulted in reduces depreciation expenses and improves bottom-line.

So that when the company is making a capitalization of depreciation then we have to look at the FCF rather than just check CFO. And when we go for FCF then it’s negative in all the periods. Capitalizing an expenditure enhances current profitability and increases reported cash flow from operations. Capitalization of depreciation will increase the value of assets which is not a part of CFO but it’s a part of CFI so that FCF will provide us a better picture.

Also, the company does not have any interest cover.

Disclosure – Companies mentioned in the article are just for an example & educational purpose. It is not a buy/sell/ hold recommendation.

This series contains learning from books –