Generally, the economy works as either a free economy or a communist economy. But the most accepted free economy also needs government interference sometimes. There are interventions made by controlling authorities for shaping the economy and help the economy to grow well.

Central Bank

Central Bank such as RBI concerns managing the economic cycle which is mainly through inflation and employment. Inflation has a two type –

- Demand-pull where the demand for products increases more than of supply.

- Cost-push where prices of labor and raw materials increases.

Central Bank involves in reducing money supply in the economy through increased interest rates, selling of securities which resulted in lower demand due to lower availability of money and inflation comes down.

Such an act also hampers the growth of an economy.

When it comes to generating more employment in the economy then the central bank increases the money supply to the economy through reducing interest rates, purchases of securities (quantitative easing), etc.

Central Bank has to maintain a balance between employment generation and limiting inflation.

INTEREST RATE CUTS: DOES IT PROVIDE LONG-TERM BENEFITS?

Government

The government has a wide area of responsibilities and the economy is one of those. The government has the main tool for managing the economic cycle is fiscal which includes taxing and spending. So, for stimulating the economy, government cuts tax, increases government spending, provides stimulus packages. Government reversely increase taxes, reduce spending and another stimulus when they feel that the economy is overheating.

Also, the government has to look after the deficit which results in the increases in debt levels.

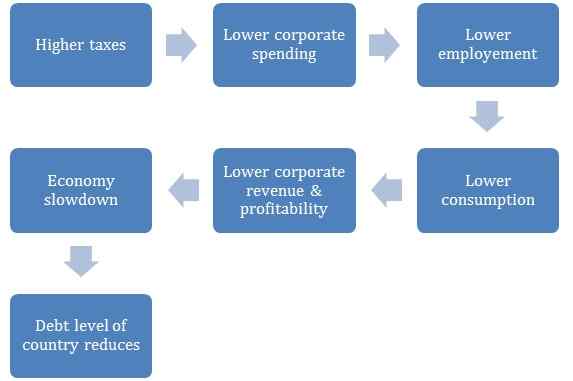

The above stimulus will invite higher taxes when either economy overheating or debt level of economy crossing limits.

If higher taxes and lower spending by the government with the fiscal surplus resulted in the lower down of debt level and the fund goes out of the economy. Reversely, lower taxes and higher spending by the government bring more fiscal deficits and that will have resulted in the increasing borrowing levels.

Similarly, currently, Government has cut corporate tax rates in India and this will have resulted in the above process mentioned in rate cut but in a longer period, this lower tax can be increasing a debt level. India is a developing economy that requires higher government spending as well so that that will surely going to increases a deficit and will increase a debt level. But for stimulating growth in the economy it is a welcome step. Otherwise, the economy starts failing. The government has to take appropriate steps whenever requires.

Disclosure – Companies mentioned in the article are just for an example & educational purpose. It is not a buy/sell/ hold recommendation.

Read for more detail: Mastering The Market Cycle: Getting the odds on your side by Mr.Howard Marks