The fourth part of Series “Once a darling, now an evil”. This series is based on the companies which were once upon a time darling of the market and now, it has wiped out the majority of all those gains. I am trying to put some of the number-crunching facts by which we have identified ongoing issues in the companies and have saved our wealth.

I am starting this part with one of the network service company which has an all-time high price of ~Rs.3500 and now last traded price at Rs.1.25. and high of Rs.464 in the year 2010.

On the first instance, this company looks having not a huge problem except debt rising but for understanding it in a better way, we need to go deeper.

If we look at the tax paid in cash flow then that tax outflow is higher than what the company has posted in P&L statement. If we look at the actual PAT and reported PAT then both have a good diversion. This shows that the company has boosted PAT by ~40%+ on an average basis.

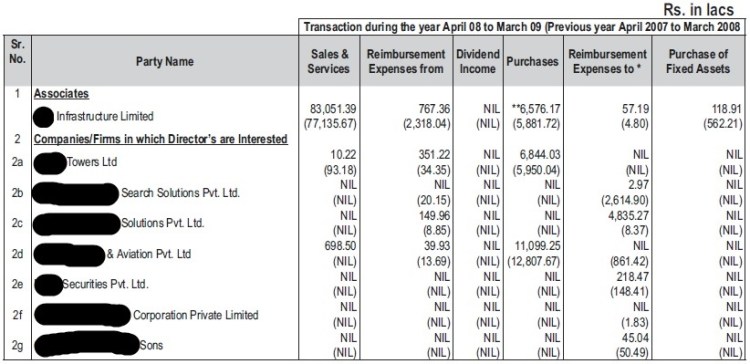

Now, if we look at the sales to the related party then that was ~44% and 43% in the FY08 & FY09 respectively. In FY09, ~44% payable was from the related party out of total payables. Company has made ~80%+ investment in its subsidiaries out of investment shown on the balance sheet. In addition, the company has 25+ subsidiaries and few were at Mauritius.

Also, during when the price was traded near too high in the year 2010, the promoter has started putting their stake in a pledge.

Disclosure – Companies mentioned in the article are just for an example & educational purpose. It is not a buy/sell/ hold recommendation.

This series contains learning from books –Financial ShenanigansQuality of EarningsThe Financial Numbers GameCreative Cash Flow Reporting