We should take care when company deliver their promises but actually traded at more than their promises. Companies that have to deliver a higher sale, earnings growth then they will be available at higher multiple. But we should distinguish between higher and reasonable multiples. Stocks which does not have underlying soundness then those will become speculative and riskier.

When sales growth keeps coming people ignore the underlying quality of business and financial. As the company grows, its growth becomes slower otherwise the company will eat up the entire world. As growth gets slower, multiple also gets lower. We need to understand that we cannot provide similar multiple to the same company at every phase of the company. Higher quality growth commands a higher multiple but as growth slows down, multiple for the same business gets lower down.

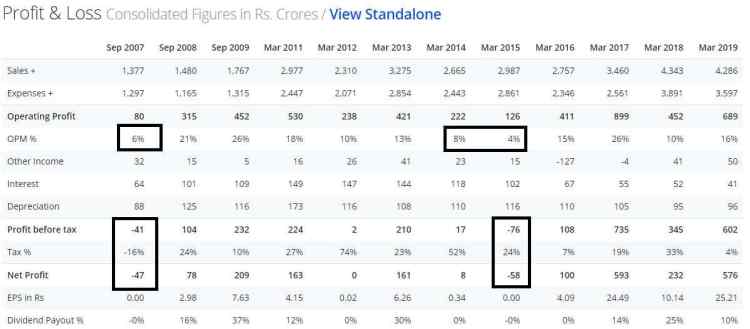

One of the air-cooler manufacturing company of India

We can see that as growth slowdown in the FY2018 and 2019 then P/E multiple of the company has fallen down rapidly.

Comparison of Real Estate VS Pharma VS FMCG

We can see that in the Jan-2008 Real estate companies (Just two companies) MCap was ~4x of 10 pharma companies and ~2x of 10 FMCG companies. Pharma and FMCG companies have posted growth and real estate companies are not able to grow at the same peace. In addition, real estate companies were traded at sky-high valuations which resulted in an average return of ~-91% whereas Pharma (*not taken from high mcap) and FMCG has posted average return of ~963% and 1109% respectively.

If we look at the fall in price too low of 2008 then also pharma and FMCG have outperformed real estate.

If we see the quality companies i.e. pharma and FMCG then those fall less than the entire market fall, Nifty fell by 50%+ in the year 2008.

In the Short term, any stocks win the popularity of the market but in the long-term earnings matters. If we see that fancy business has does not perform in the long term but boring business such as FMCG has outperformed in the long term.

If we look at the P/E multiple of DLF and Unitech then that was 36.69x and 82.22x in high of the year 2008 and that fall to 4.67x and 4.21x respectively. Whereas Lupin, Sun Pharma, HUL, ITC, and Nestle was traded at P/E of 13.54x, 17.91x, 26.23x, 29.34x, 26.90x and fall to 12.50x, 17.52x, 26.71x, 22.28x, 24.80x respectively.

Market panic provides us with an opportunity to enter into such business which helps us to get more returns. If we have bought the above-mentioned pharma and FMCG companies at a high of the year 2008 and then bought again at low of the year 2008 then-current average return of pharma and FMCG has been increased by ~347% and 137% respectively.

For the current scenario, if we see HUL MCap vs 10 Pharma companies then HUL has a 24% higher MCap from pharma 10 companies.

This analysis is given by many of the investors and fund managers but if we look at the return ratios then average RONW% & ROCE% of top 25 pharma companies is ~20% and average RONW% & ROCE% of top 10 pharma companies is ~16% whereas RONW% & ROCE% for the HUL is 80% and 90% respectively.

So, if we look at the growth and profitability of the top 10 pharma and HUL then does not has a wide difference but asset quality is far good for HUL compared to the top 10 pharma which must need to look. This comparison is not similar to real estate and pharma and FMCG whereas real estate has poor asset quality compared to the pharma and FMCG but here HUL has a better asset quality. If pharma has a huge earning growth compared to the HUL with 15-20% of return ratios then we can look into it. If we look at the ~73 listed FMCG then those companies do not have similar asset quality then they do not have a similar kind of valuation but those have, they command.

Closed watch also shows real-time sometimes in a day that does not mean, we consider that watch as a good watch.

If we compared sugar companies’ vs tea & coffee companies then it can be a good comparison where sugar companies are available more than double in MCap.

Disclosure – Companies mentioned in the article are just for an example & educational purpose. It is not a buy/sell/ hold recommendation.

Read for more detail: The Intelligent Investor by Benjamin Graham, Jason Zweig