Enterprising investors are willing to put more attention and efforts for generating a higher return.

Generally, an intelligent investor buys and keep holding common stock when it has a cheapness and they sell a common stock when it becomes overpriced. After selling off the stock they transfer to the bond and wait till another opportunity of common stock available with the cheapness.

General Market Policy—Formula Timing

This is an approach of investing timing of the market. The market keeps on fluctuating and taking a benefit of those fluctuations to our favor adds additional value. It is very difficult to forecast the future market level for a consistent period. When we look back towards any situation then it looks easier to predict but when we are passing through the situation then it is very difficult to predict.

Growth-Stock Approach

Growth stocks are the companies which have shown a growth better than an average. The problem with such kind of companies is they have given good growth into the past and we have to assume that they will keep on doing the same into the future. But such kind of stocks selection needs huge careful attention from the investors. As the bigger companies start to grow at a slower pace compared to the smaller companies. But it is also a fact that if the company is a leader with the availability of competitive advantage in the market then it has a huge probability of growth. We need to careful with what we are paying for buying a growth. If we pay a sky-high price for the prevailing growth then also, we have to suffer through the company grows.

If we have proven wrong with our assumption of future growth and also, we have paid a higher amount for the business, then it will be a dangerously affect to our wealth. Growth stocks can create our fortune or can spoil our fortune. If our assumption for the future growth proven right and also, we have bought the stock at a proper valuation then fortune into the growth stock can be created. Many times, the company has a temporary problem, then it will be available at a relatively cheaper valuation. When larger companies have adversity, they have a resource and brainpower to come out from the adversity and market responds quickly to such improvement to the larger company.

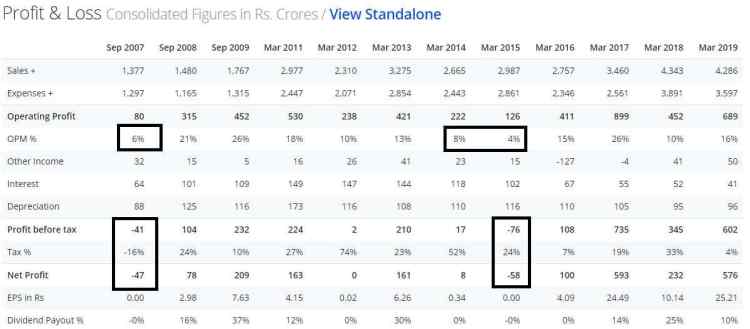

One of the two-wheeler company of India

The company which has a negative cash conversion cycle, availability of float, market leader since many decades, traded at 10%+ of earning yield with higher return ratio, market participants having a fear of electric vehicle disruption.

One of the MNC FMCG company of India

Company’s one of the flagship product got banned which contributes decent revenue to the company. Also, no other competitor gets success in the same product at the same level. Company has a higher return ratio, good brand over the globe, successful track record.

Mr. Graham mentioned regarding a cyclical business –

We need to bought such businesses during the bad time at higher multiplier and need to sell it at a good time at a lower multiplier. During the bad time, the profitability of the company gets depressed which resulted in the higher multiple to the company and reversely, when time is good, profitability gets improvement which resulted in the lower multiple.

One of the sugar company

When we want to get an above-average return into the investment, then our investment needs to be proper, sound enough to avoid risk and we need to adopt a policy which is different from most of the investors or speculators are using.

Bargain issues are those which are selling below its true worth. Now, for calculation of bargain – first, we need to forecast future earnings and giving it an appropriate multiple for arriving at a future market price. If the current market price seems lower than future market price then we can consider it as a bargain common stock. And second, where we need to focus more on the net realization of the asset value and net working capital (Working capital – all obligations) with the growth into the future earnings. Also, the current result is disappointing (future result can be improved) and unpopularity among the stock price creates a bargain opportunity. During a bear run, people do not focus on the companies which are not a leader, because they have a fear and belief that leader can provide safety. So that companies other than leaders will be available at a cheaper bargain price. We should focus that whether these companies can generate a fair return on invested capital or not and whether that generated return will be above the cost of capital or not. Such companies require a bull market, changes in policies, changes to the management, acquisition of smaller bargain companies by a larger one, etc. for reaching the fair valuation.

A special situation is also one of the ways to create a return on our investment. Special situations are different from the usual part of investing. Here, we need a different kind of process and different level of mentality compared to the usual one. This strategy includes demerger, merger, arbitrage, delisting, buyback, right issues, etc.

When we select to be an aggressive investor rather than a defensive investor then we require a thorough knowledge of businesses, how to value it etc. There is not a middle way between aggressive and defensive investment. And those who are involved in the middle way, they get a disappointment to the result due to the lack of requiring time and knowledge.

Disclosure – Companies mentioned in the article is just for an example & educational purpose. It is not a buy/sell/ hold recommendation.

Read for more detail: The Intelligent Investor by Benjamin Graham, Jason Zweig