Warren Buffett’s Letter 2001

We need to analyze financial statements and notes to accounts with huge care so that we can identify flaws which management wants to hide.

Indian companies Examples – Companies having growing sales but the majority of sales from related parties.

The company engaged in manufactures pumps, motors, valves, and custom-built power systems/manifold blocks.

The company is a travel management company.

Warren Buffett’s Letter 2002

Acquisitions

Berkshire has made a five investments in the year 2002 which are Albecca (U.S. leader in custom-made picture Frames), Fruit of the Loom (the producer of about 33.3% of the men’s and boy’s underwear sold in the U.S. and of other apparel as well),CTB (a worldwide leader in equipment for the poultry, hog, egg production and grain industries), Garan (a manufacturer of children’s apparel, whose largest and best-known line is Garanimals) and The Pampered Chef – Founder Doris Christopher (in a business of manufacturing kitchen tools, food products, and cookbooks for preparing food in the home).

John Holland who is managing Fruit has Rescue Company from the disastrous path. We can see that if the management of the company is capable enough then he can run the business in a good manner rather than spoil it.

Two company from the same segment one has survived under the worst period and other has made a disaster.

The company has a sales growth, growth in cash balance, free cash flow for the cumulative period, a major portion of the assets side of the balance sheet is Net Block as a company is into the capital-intensive industry but investors of the company do not lose money.

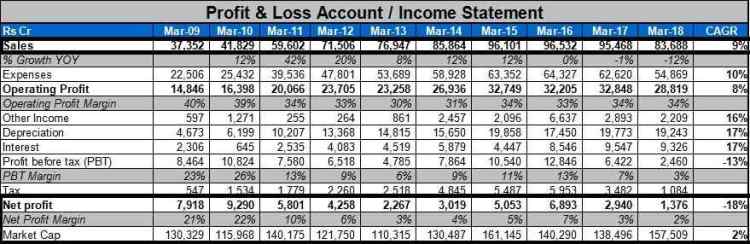

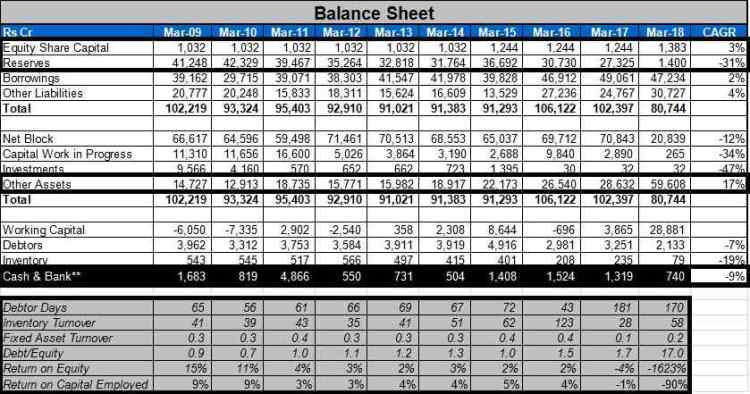

Second company which has made a disaster

Another company from the same segment where the company has does not have a sales growth, reduced cash balance, no free cash flow for the cumulative period, a major portion of the assets side of the balance sheet is other assets and investors of the company has lost money.

We can see that the management of the company plays an important role in making a company successful and survive during the worst period also.

Berkshire has made an investment into MidAmerican Energy Holdings in the year 1999 for $35.05/per share and per-share earnings of MidAmerican Energy Holdings in the year 1998 was $2.01 (P/E 17.44x, Earning yield of 5.73% – US interest rates during the year 1999 was similar to earning yield).

View on Derivatives

We should wait for the opportunity which is falling under our criteria and till that time we should be inactive. We should work for staying into the game rather than try to hit on each and every ball thrown to us.

I will be going to make a detail explanation regarding weak earning quality later on. But I learn from my Guru that we need to start analyzing every company by considering it as a “Chor” so that we will not be biased about the company. If our process proves that the company has not a weak quality of financial then only need to consider the company as a clean company.

Warren Buffett’s Letter 2003

Mr. Buffett has again mentioned waiting for an opportunity which matches our criterion.

Director of the company should have the freedom to make an independent decision and they also should be an owner of the company so that their interest and interest of shareholders will not have any kind of conflict.

One of the lesson if there is a bubble scenario and we know that the price at the business traded is much higher than what actually an intrinsic value of the business then we need to sell out our position.

Indian example

One of the wealth creator from IT segment. If we have sold out shares during an IT bubble period year 2000 at half price Rs.140 from the high price Rs.279. then we have lost return of 9% CAGR since the year 2000 (current price Rs.650). Now, we have bought Nifty Bees from those sold amounts then we have earned 13% CAGR till now.