The tenth part of the Series is “Current temptation, future frustration”. This series is based on the companies which are currently darling of the market and many trying to catch such opportunities but it has a probability to become a reason for future frustration. It can wipe out the majority of gains in wealth. I am trying to put some of the number-crunching facts by which we can identify ongoing issues in the companies and can be saved our wealth.

I am starting this article with one of the company which is engaged in the business of trading has a 52 weeks low price of Rs.9.60 and LTP is Rs.62.2, a 52-week high of Rs.79.2. This company has rewarded ~6.48x of return in a year.

Let’s start looking at the numbers.

We can see that the company has high volatile sales, OP Margin% and not earning profits.

We can see that higher receivable days and payable days where we can say that almost 3 years of receivables and a year of payable. Shocking…..

The major balance sheet item is advance recoverable and for that, there is no provision made by the company.

The company does not have a good return ratio.

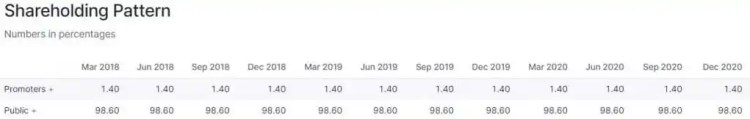

When we look at the shareholding pattern then promoters hold only 6.89% now and the remaining hold by the public. If the promoters have trust in the performance of the company then they have to hold higher holding.

This entire series is based on past available data and ignored the future development in companies and the stock market always looks at the future.

Disclosure – Companies mentioned in the article are just for an example & educational purpose. It is not a buy/sell/ hold recommendation.

This series contains learning from books –