When there is unusual profitability, higher return ratios command by a business then such businesses attract the incremental capital from others. This incremental capital results into the stiff competition and particular business become crowded where such unusual profitability and higher return ratio gone for a toss.

Reversely, businesses which are not able to generate huge profitability, higher return ratios, huge capital requirements etc. then such businesses fail to attract the attention of the new capital so that fewer players remain in the industry and due to challenging business environment, those few also reduces. This consolidation results in moving a cycle of profitability and return ratios to the improvement level.

Examples – high profitability and return ratios become lower (Telecom) and

Merely 2-3 telecom operators to ~14 telecom operators and then again reach to strong 2 telecom operators. This journey suggests the rise and fall of companies.

lower profitability and return ratios become higher (Paint)

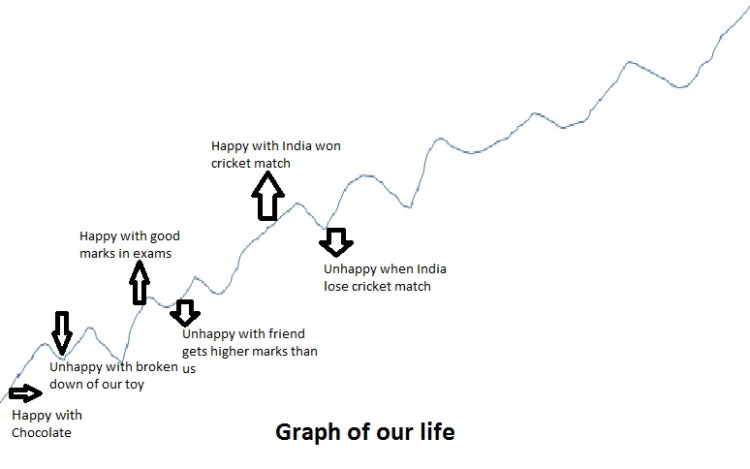

So that we need to understand that business does not grow to the sky. They all have a cycle. Also, we need to keep in mind that best investors do not get successful all the time. Our human nature makes our success and that also moves in a cycle.

Success changes the people and they start thinking that they are smarter. Success has a negative consequence also where people become richer and motivation level of them started reducing. Unconventional thinking transforms into conventional thinking. Rather we should know our limitations and also, need to understand that we can fail though we become successful investors.

Successful investors believe that they are mastered in the investing and they have less self-doubt, the worry about being wrong and risk of losses. This invites the risky situations.

We have to keep in mind that – “Don’t confuse brains with a bull market.”

Success teaches us to make money and failure teaches us an important of the risk aversion. We always have to focus on risk while balancing between the aggressiveness and defensiveness. When there is a bull market, everyone gives us a piece of advice. But the quality of advice getting checked during the bear market only.

Making money in the market is always an easy task but keeping secured that earned money is a difficult task.

We keep doing hard work and keep learning for achieving success in the investing journey. One success does not make us a successful investor.

If we have earned an Rs.100 cr but we do not have the skill to keep it secure then it will not take time to again reach at zero.

We have seen that when the asset is not accepted by the crowd and all are uncomfortable to hold then the particular asset will be available at a bargain. Similar to us, when we start getting popular, everyone wants to make contact with us, everyone accepts our thoughts then we will not be available at a bargain. We also become crowded. We have to keep ourselves grounded and keep reminding ourselves that no rule, no strategy will work forever.

When risky assets are penalized by the market and due to that, it will be available at the valuation where it will be no riskier.

When there is a monopoly of the business, business generating good return ratios, decent profitability etc. These invites a competition, these plants a seed of failure. Reversely, when everything seems to be worst, then seeds for success getting planted.

Examples – monopoly kind of business worsening due to competition (Auto OEM) and

Competitive business turns out to be good (Footwear)

We believe that a good time will follow more good times but actually, we forget the cyclical nature of everything especially success. So that good time itself having a seed for the bad time and bad time itself having a seed for the good time.

Disclosure – Companies mentioned in the article are just for an example & educational purpose. It is not a buy/sell/ hold recommendation.

Read for more detail: Mastering The Market Cycle: Getting the odds on your side by Mr.Howard Marks